Tree of Woe here! I am back from my (mis)adventures in Republican politics. While I was out hobnobbing like the international national municipal playboy I am, Aleksandar Svetski was working on this remarkable essay on Aenean Money. Like the other pieces in the Aenean series, it’s less about contemplating woe and more about contemplating what comes after the woe. Read on, and be sure to grab Aleksandar’s book if you haven’t already.

Last year I read Tree of Woe’s ‘The Dawn of a New Civilization’ and it’s been on my mind since. Its optimistic, ascendant tone is one which we shouldn’t be ashamed of adopting. On the contrary.

That same year, America and the world literally dodged a bullet: the dynamic and the culture changed, and we’ve since found ourselves on the right side of the pendulum swing. This change allows us to think about the future.

Woe is on point regarding the principles of the Aenean Age, so I decided to write a piece to contribute to the vision.

Credit: @PabloPeniche on X. Go follow him, his stuff is incredible.

Out of all the possible aspects of this new age to write on, some readers will no doubt raise their eyebrows at my choice of topic. There is among the Right a certain suspicion or at best ambivalence regarding money. And that is not only a healthy view, it is a traditional one.

The best and most noble minds throughout History – whether from the Apollonian, Magian or Faustian cultures – have always been extremely wary of money changers, lenders and the pursuit of material riches.

“The Life of Money-making is a constrained kind of life, and clearly wealth is not the Good we are in search of, for it is only good as being useful, a means to something else.” — Aristotle

The noble are preoccupied with higher values and goals than material wealth. Money is of the earth, to be looked down upon, while the noble’s gaze should ever glance upwards.

So why, then, write about money?

To begin with, money is a tool, and like all tools it is meant to serve a specific function. In the case of money it is to facilitate exchange between parties, thus solving what is known as the problem of the coincidence of wants: as an economy scales, as specialization increases, barter becomes highly problematic, and people seek an intermediary to fulfil the function of medium of exchange. Just like you can’t build a house without masonry tools, you simply cannot build a strong civilization without money.

More broadly, due to its primary function, economics teaches us that money is a framework for social cooperation. We compete to acquire it, yes; but in doing so – and that is the wonder of capitalism – we all get access to a greater diversity of goods, of better quality and at lower prices. That, at least, is the theory. We will see below why that has only partly manifested, and at what cost.

That tool, though, is not only corruptible but corrupting. And so it comes as no surprise that our great moral teachers warned of its dangers; to wield it properly requires wisdom and discipline. If a society – from the lowly to the higher up – is obsessed with money and materialism it is precisely because that tool is broken. For Faustian Man, there is simply no retvrning to a world where the role of money is not central. Thus, a new chapter must begin, one in which both society and its money are radically different in their aspirations. This will be the core topic of this essay.

If we are to overcome our current predicament we must understand that, like a sword, money is double-edged. We must develop the character to master its blade. So the reason I chose to write about money is because the noble of the future, the true elite, must wrestle with and wield it. They must develop both Capital and Character.

A Brief Look at the History of Money

Money is essential, and will remain so for as long as humans are bound by time and space. So what forms did it take in prior cultures? Much has been written on the history of money – Nick Szabo’s ‘Shelling Out’, which I highly recommend, being among the best. But in this essay, I’d like to provide an original approach to its development: the evolution of money, through a Spenglerian lens. We will later use this framework to describe the characteristics and design of Aenean Money.

Let’s begin…

Apollonian Gold

In line with the Apollonian attraction to the natural, the physical and the concrete over the metaphysical and the abstract, its culture employed precious metals to capture economic value and move it across time and space.

Gold and silver are material, tangible, solid in form.

Few aspects of Apollonian culture reveal its emphasis on purity and harmony more clearly than its money: gold is incorruptible and malleable, and can thus adopt a multitude of forms; Apollonian man shaped his money into discs, the ideal shape; and gold soon came to define the highest standard against which to measure everything.

Moreover, Apollonian money was naturally a bearer instrument – that is, coins and bars themselves carried the value expressed, because they were made of the valuable material. This is natural and desirable of course; only centuries of experimentation, ‘progress’ and manipulation made it possible to conceive of a money that was not a bearer instrument – but more on this below. What’s important here is that Apollonian money was final and present, not deferred in time (credit); it was also a more localized form of money: its very materiality made very distant trade extremely costly – a sort of natural check on globalization.

Finally, money was intimately tied to civic identity – to the polis, kingdom or whatever other political model. This meant in effect that the economy of the polity had a real, concrete, material substrate (like Athens’ silver mines of Laurion): a solid foundation for social cooperation and the pursuit of the common good.

Apollonian Gold

This all sounds very good… and it was – to some extent.

Naturally, the very physicality of gold and silver made them extremely easy to control, co-opt and manipulate. Metal monies allowed for flourishing trade, which was instrumental not only for building architectural and sponsoring artistic wonders, but also to fund Roman ingenuity and engineering. The other side of that coin (if you’ll allow the pun) however, is that the temptation to mess around with the real value, as opposed to the nominal one expressed on the coin, was simply too great.

Many historians have written on the debasement of physical moneys: to ‘de-base’ the money literally meant to decrease the quantity of the base-precious metal in the coin. Each of these debasements led to their devaluation and collapse. The progressive debasement of the silver denarius – which started at 100% purity and ended with a mere 5% – was one of the key factors in the decay and ultimate fall of the Roman Empire.

Magian Mysticism

Magian Man (if we place him between 0 and up to 1000 AD) did not fundamentally innovate with regards to money: his gaze was at once more outwardly and more inwardly. Perhaps the only real monetary innovation in that time was the creation of a financial network operated by money specialists in most countries around the Mediterranean basin – both Christian and Muslim.

French Medieval stalls

From the heights of Roman ‘globalization’, trade started to recede during the 3rd century AD as the population moved away from the cities. It survived in the Eastern Empire and subsequently in the Islamic world – still very much urban civilizations – but there as much as in the West proper people fervently sought a different kind of truth. The spiritual kind.

There is therefore little to say with regards to money, except that it essentially kept its Apollonian form, was regarded with suspicion – not only by the nobles this time, but generally through the influence of the Church – and that great efforts were made to discourage usury and profit-seeking.

The major economic and monetary event of that age was of course the discovery of the New World, which resulted in an unprecedented influx of gold and silver into the Old Continent. This empire-shattering reality led to deep theological debates throughout Europe which illustrate the attempt of Magian Man to wrestle with the concepts of money, value and wealth – both material and metaphysical – and their relation to God and philosophy.

The discussion was at the time led by the Spanish scholastics – the so-called School of Salamanca – a curious precursor to the Austrian School of Economics in that they recognized the subjectivity of value, developed monetary theory and emphasized the importance of free-market pricing and property rights, from a theological perspective.

The medieval University of Salamanca

They failed to convince their rulers, the kings of Spain and the Americas, however. El Dorado was too great a temptation and this desire ended up flooding European markets with precious metals and inflating their currency. It eventually led to Spain’s financial ruin, as the empire stretched beyond what they could afford to defend…

A valuable historical lesson: to endure, empires must wield both iron and gold wisely. Magian Man, for all his suspicions, eventually succumbed to the allure of gold, and civilization had to reinvent itself once more – and reinvent money in the process…

Faustian Fiat

The Faustian soul craves constant striving, abstraction and infinity. It explicitly rejects Magian mysticism and, though it often claims the Apollonian legacy, its drive repeatedly expands outside the strict limits of order and harmony. It is only natural that the limits of physical currency would prove intolerable for this culture.

As it turns out, paper travels much faster than gold; and information (once the telegraph and then the internet were invented) travels at essentially the speed of light. As a result, people started exchanging claims to gold, rather than the metal itself, leaving specialized companies responsible for final settlement among themselves: Faustian Man created banks as we know them – not as secure locations to deposit your gold, but as a key institution in the tapestry of civilization.

Paper money befits the expansionist desire of Faustian Man, as well as his obsession with abstractions. But just like metal money could be manipulated, thereby eroding trust in institutions, so too paper money presents great risks. Besides forgery (much less costly than with gold), the circulation of paper claims en masse led to the progressive concentration of gold in a few major institutions; not only that: these institutions got greedy and predictably started emitting more claims than they had gold, creating the concept of fractional reserve banking and the inevitable bank runs.

This in turn led to the creation of Central Banks, whereby the State assumed oversight of the banking system and, more importantly, of the currency; just like with gold, the State eventually co-opted the social institution of money, under the guise of “protecting us.” The reality, of course, is far more sinister. (I recommend: The Creature from Jekyll Island to really understand what happened here).

The Bank of England (est. 1694)

The need for speed and abstraction continued to accelerate on par with technology, and by 1971, the very idea that money needed to be tied to anything physical, tangible or scarce, died.

In 1971, the US Dollar, the global reserve currency, backed by the largest military in the world, decoupled itself from gold and became a true fiat currency. Under the new framework, money was no longer a bearer asset, could be printed to infinity, and was always someone else’s liability. And while this gave the US a great advantage at the time, it was ultimately a deal with the devil. Decades of money printing – the fiftieth anniversary of Nixon’s move was fittingly peak Clown World in 2021 – has turned the world into one giant ball of debt, asset bubbles, and infinite abstraction.

When money is no longer tethered to reality, it turns everything it measures, and everything it is used to build, into a fake, distorted and ghostly version of itself: homes become mere investments; businesses are built as quick pump-and-dump schemes or as hooks to generate addiction – to create demand – instead of solving concrete problems – meeting demand – thus feeding the fake financial Ponzi scheme we are all now subjected to…

People no longer buy things because they need them, but because they have been conditioned to consume and because saving is penalized.

When the money is broken, it distorts everything else it touches – and since money is so foundational for human civilization, the negative downstream effects are simply too costly to even fathom... Such is the cost of making a deal with the devil: the debt comes due.

This is where we are now, with the shared intuition that the system cannot continue, and that monumental change lies ahead… for better or for worse.

Defining the Aenean Soul

Before we go deeper into the properties of an Aenean Money, let’s quickly define what characterizes the Aenean soul. I’ll keep it brief and refer readers who want a deeper explanation back to ‘The Dawn of a New Civilization’ essay by @treeofwoe himself.

The Aenean soul is more mature than the Faustian. More aware of its place in History and the cosmos. It recognizes and respects both physical and divine boundaries in a way the Faustian soul never did. Its defining shape is the arc, both the opening of a gateway: the transition between two worlds, and a geometric shape with a start and an end.

Where the Faustian Spirit is adolescent in nature, the Aenean Spirit is a Man able to weave the wisdom of ages past together with the audacity to conquer the stars. Aenean Man will be born of the turbulent Interregnum as the old world dies and the new one emerges. This is symbolized by the two piers on which the arch rests. It is the resacralization of the liminal, of bounded potentiality. Consider the Roman triumphal arches: the concept of threshold, the awareness of transgression and potentiality as one passes through onto a new reality...

“Arches also serve as a warning that all that rises also falls.”

In contrast to the extremes and linearity of the Faustian soul, the Aenean soul is more prudent in its strivings. The thirst for knowledge, arguably pushed too far by Faustian Man will be tempered; not discouraged, but confined within clear, definite borders. This is wisdom, as opposed to just knowledge:

“a soul animated not by ambition for ambition’s sake, but by the delicate knowledge that humanity stands at a threshold, a liminal space with a clear choice: to transcend or perish.”

Aenean Man cannot simply turn his back on technical innovation and return to Apollonian or Magian times and concerns. The only way is forward… and the Faustian he will overcome. The first step will be reestablishing a solid foundation: an honest framework for cooperation, so we may start anew.

Gaze upwards… to the stars.

Aenean Money: A Blueprint

Before we design this money of the future, let’s establish the main attributes of money:

The Austrian School of Economics similarly defines sound money as having three primary properties:

salability across space: it needs to be easily transported, which implies capturing high amounts of value per unit.

salability across time: it should hold its value in time, which means resistance to the elements as well as to inflation.

salability across scales: it needs to be easily divided and aggregated to facilitate exchange at different scales.

In other, perhaps more familiar words, money must perform the following functions. It must be:

A store of value

A medium of exchange

A unit of account

Different moneys perform these different functions to varying degrees of efficacy. The more of the properties outlined above it has, the better it performs each of these functions, and thus the more likely it will be used as money – not by decree, but by choice and necessity.

As far as technical attributes, properties and functions go, these definitions are fundamental. However… Aenean Money must go beyond. It must capture the physicality of Apollonian gold, the spirituality of the Magian soul, the economic prowess of Faustian man and it must remain incorruptible.

Aenean Money must be true – reflecting the real economy – and itself be a source of truth. It must stand above kings, and remain out of reach of all men: akin to the laws of physics.

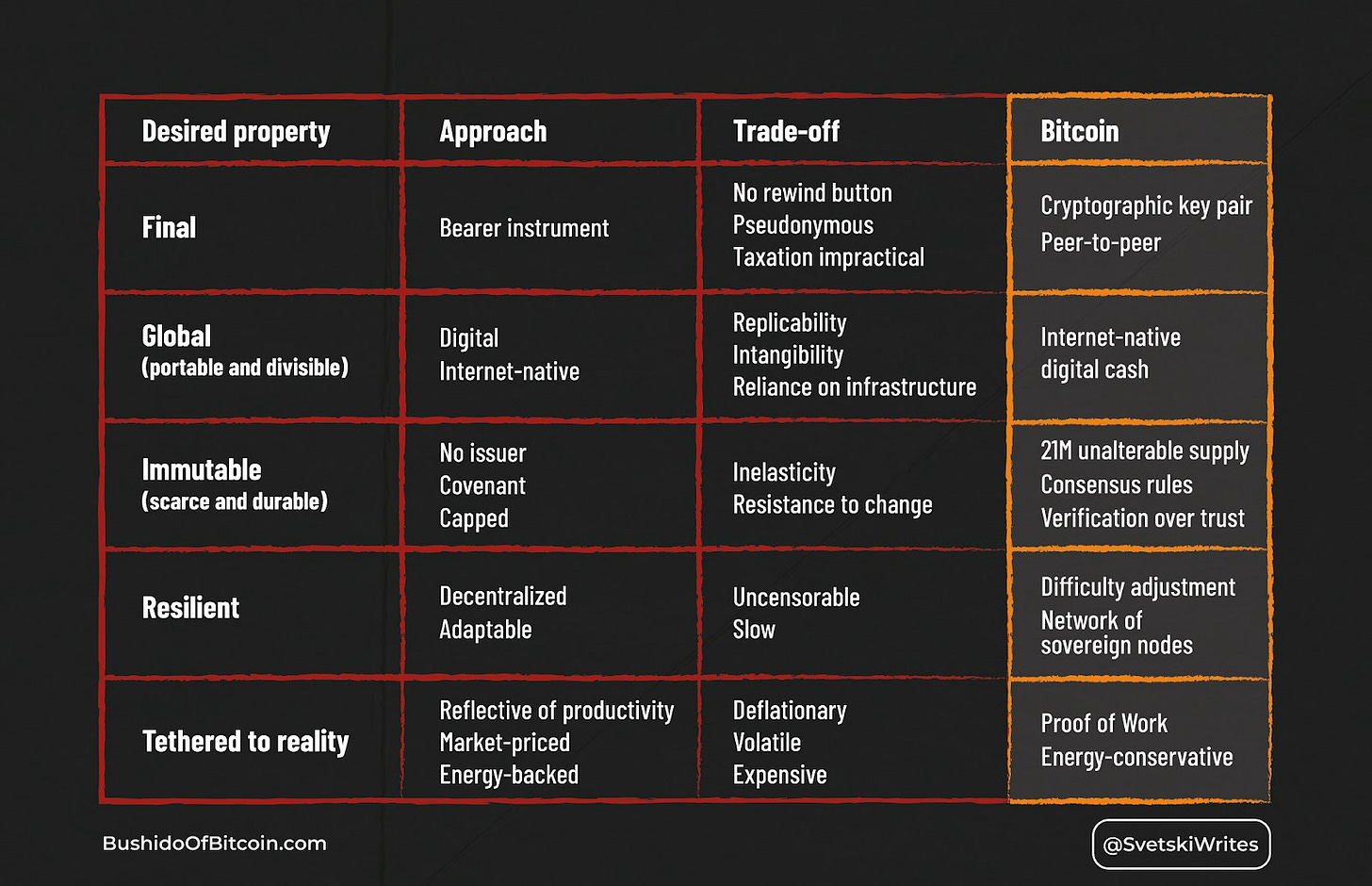

As such, Aenean Money must have properties of its own, that are both a blend and an extension of those listed above. Of course, each of the properties will come with trade-offs – nothing comes for free – but if we are to redefine the framework for social cooperation in the next age, it is key to understand and accept such compromises.

Foundational finality

If Aenean Money is to be true, it needs to be final. Each exchange must settle the transaction or, in other words, instantly ‘cancel the debt’ – as opposed to simply passing on that debt to the next man, which is how Faustian fiat functions.

Thus Aenean Money must be a bearer instrument where the asset itself holds the value (rather than a promise to that value) and its holder is the absolute owner. In other words, it must be a commodity money, similar to gold, which has historically been the soundest. Like Apollonian Money, Aenean Money will be actual and present, rather than abstract and deferred, because we cannot base society on abstractions of abstractions…

Bearer assets come with two important trade-offs. The first one, a direct implication of carrying value in itself, is that there is no rewind button: just like with cash, if you misplace it, give it to the wrong person or have it stolen from you, you have quite simply lost that money; any transfer is final and irreversible. Such an instrument demands a minimum of responsibility from its bearer.

The second trade-off that will have to be accepted is that cash comes with a degree of anonymity that can create room for criminal activity, and make taxation impractical.

Global

For mankind to reach the stars, competition, commerce and also cooperation on a planetary scale will be necessary. This does not mean having a one-world government or no borders; far from it. Across history, empires have fought with both iron and gold. Both force and money are universal languages.

This new sound economic substrate must be planet-wide. Thus Aenean money must be a global language that can be used both for international cooperation and competition. This is essentially what the dollar is today: the US has geopolitical rivals, but its money is still the world’s reserve currency.

Gold played that role for millennia before the USD… but physicality has its trade-offs. Its scarcity made it valuable, but it came to be too ‘slow’ – both in terms of portability and divisibility – for an increasingly interconnected world. And, as mentioned earlier, the very tangibility that made it valuable in the first place also contributed to its centralization. It opened the door to something faster, more nimble...

Paper money initially solved a real problem: it made money faster. Fiat represented a conscious acceptance of the trade-off of potential devaluation (inflation: less salability across time) to achieve higher connectivity, portability and divisibility (salability across space and scales).

To facilitate the global exchange of both ideas and goods, Aenean Money will have to find a way to be as good as gold, and as fast (or faster) than fiat. It must therefore be digital.

Fiat is already mostly digital and there is simply no putting that genie back in the bottle: cyberspace is the new dominant arena, and any new money will have to be internet-native to be salable across both space and scales.

The challenge is to retain connectivity and maximize divisibility without devaluing the money.

This challenge is all the more daunting considering that digital information is anything but scarce. Data is easily copied and can therefore be replicated essentially for free, introducing the double-spend problem: how can I be sure that the unit I possess is not a copy of another (e.g., like JPEGs), and that my spending it will be valid? Aenean money must solve for this.

Another major problem with digital money, aside from the ease of manipulation and replication, is its obvious reliance on infrastructure. Aenean Money will therefore have to find ways to increase its resilience as well as its resistance to manipulation.

Immutable

Faustian fiat relies on institutions to ‘manage’ the value of money through policy; but as history has shown, such power will be abused. Even Apollonian gold, due to its physicality, was vulnerable to inflationary policies via debasement, centralization, and manipulation.

The defining rules of Aenean Money thus have to be set in stone, completely impervious to inflationary temptation: the asset itself needs to be unalterable, its ownership beyond question and its supply transparent. In this way it may act like a digital constitution, a ‘foundational text’ as are the US Constitution or the Ten Commandments.

Greek Law was literally ‘set in stone’.

To ensure the game cannot be altered, Aenean Man will need to solve the following paradox: every user must be an auditor and yet no one can unilaterally change or manipulate the rules.

There can therefore be no issuer and no central institution responsible for the quality of the money. The money itself must be the institution. This can only be achieved if the game you’re playing is defined exclusively by the rules you decide to follow: you’re free to play by other rules, but then you’re playing a different game than anyone else who subscribes to the original digital constitution.

In that way, Aenean Money will represent a covenant, a network of individual actors voluntarily deciding to play by a certain ruleset. A useful parallel is that of the Law: a society is not just its laws, but also the degree to which its members are willing or unwilling to apply them; i.e. whether they are willing to play that particular game.

What makes a society is the successful iteration of a voluntarily-engaged-in game. The more people decide to play by its rules – the broader the consensus – the more resistant to manipulation a society or a construct like Aenean Money will be.

And because of network-effects, the more people join, the higher the cost of changing and the greater the downside of not being involved gets. If Aenean Money can achieve network escape velocity, its role as a social institution becomes a self-fulfilling prophecy.

Absent an issuer, Aenean Money moves away from the ‘ruler’s money’ to a ‘money of rules’. An important distinction if we realize that even the most just of kings passes on and there’s no guarantee the next one will be as just. Therefore, like Supreme Law, like the Covenant, Aenean Money must remain out of reach of human impulse. For that to happen, in some sense, it cannot be a ‘product,’ designed and launched commercially. Having no issuer and being neutral to geopolitical pressures means also having no CEO, no one controller, no single and fallible point of failure – no head of the snake to cut off, so to speak. Once the cat is out of the bag, or the genie is out of the bottle, it must take on a life of its own and live or die by its utility alone. Aenean Money must therefore be an autonomous, independent and emergent social institution.

But… making money autonomous and impervious to change does not come for ‘free’. For one, it requires very clear and predetermined rules, which renders it inelastic. This means it will take time for it to adjust to sudden changes in demand, resulting in volatility. This is reinforced by the nature of consensus, which can get messy, and is by definition reluctant to change (it’s conservative); which in unstable periods can further exacerbate volatility due to confusion and interpretation.

But again: the whole point of setting covenants in stone is that stone is stone, no matter how much we argue about it…

Resilience

Aenean Money must be impervious to change and manipulation and it must also be resilient to attacks, catastrophe and technological progress. This in turn will demand a certain adaptability, contradicting in part what I’ve talked about above. Because of its digital nature, Aenean Money must remain relevant and reliable in the face of ever-expanding technological development, so that it never becomes outdated on purely technical grounds: part of being set in stone is that it must be durable.

But how can it be both immutable and adaptable? Part of the answer will lie in the system’s architecture. Aenean Money must primarily consist of a hard-as-rock, reliable, conservative, unyielding base layer, on top of which more flexible abstracted layers can be built – mimicking how paper money originally represented and was pegged to gold, in order to make payments more agile. Or for that matter, how all natural systems scale up - whether the arteries, veins and capillaries through to neural networks in the brain or river deltas in a watershed. There’s nothing a priori wrong with abstractions… that is, as long as they remain firmly tethered to a source of truth.

Besides the more technical aspects, Aenean Money’s decentralization of the enforcers and auditors is a great natural defense against attackers: since its rules are enforced through consensus at the participant level, any actor – malicious or otherwise – who would want to change or manipulate Aenean Money would need to bribe or persuade a vast number of participants to alter the covenant and define a new consensus. If we add to this its global nature, Aenean Money would be antifragile enough to survive natural catastrophes, provided they are not of a planetary scale – in which case money would be the least of our concerns…

The main trade-off associated with resilience via decentralization is that there is no effective way – except by consensus, which is hard to achieve – to change it, influence it or censor it. Aenean Money will be neutral, so once it is running you cannot stop anyone from using it – including your friends, allies, enemies, or criminals. Therefore, Aenean Man must come up with other ways to stop crime and compete economically. The days of censoring transactions and using money as a geopolitical weapon will be over. Cracking a few proverbial eggs will no longer justify intervention. To reiterate: the covenant must remain out of reach of human corruptibility.

These are acceptable terms in my opinion. Benefits in fact. By resisting bureaucratic red-taping Aenean Money will reject longhousing the morality of transactions between adults and lead to a more mature culture.

Tethered to reality

True money is so as long as it accurately maps reality.

Aenean Money must therefore reflect the actual economy and real productivity. A consequence of that anchor to reality is that the money will increase in purchasing power as the economy grows (price deflation) and will lose purchasing power if the economy contracts (true or natural price inflation). A money that reflects the true economy will shatter the illusion of all things inevitably going up in price (think your typical Big Mac in the last couple of decades) – including salaries, which would only go up to reflect gains in productivity, not to keep up with monetary inflation.

Pre-fiat commodity money always implied some amount of energy expended – of work done – to extract, mint and exchange in order to accurately represent productivity. Such money thereby acquired the property of energy (or value) retention because the cost was up-front.

Fiat, however, is virtually free to create at will, with the result that it impoverishes everyone but the money printers and those closest to them: it is leaky, as opposed to energy-retaining and conservationist. The cost is simply deferred to later generations through the endless emission of new debt.

In the end, cost is always there. Aenean Money must reject the hedonistic fiat framework and pay its dues, both present and past; and the best way to do this is with energy-backed money that has a clear and upfront cost. And since it must be digital, this tethering to reality through energy expenditure is all the more important. It must be like a commodity.

And like a commodity, Aenean Money will also have to be priced by the market. This is for two reasons: first, so that it can accurately represent productivity (map the territory); second, a money without an issuer by definition cannot be a fiat money. This means that its value cannot be decreed by anyone (by fiat). Only those who choose it can ascribe it value.

This in turn will make it volatile, as it becomes subjected to the law of supply and demand. But if volatility is the price to pay for such a retethering, then at least uptrending volatility is preferable to downtrending volatility, which is guaranteed with fiat.

Aenean Money will only be adopted voluntarily by participants if it works. Contrast this with fiat, which on top of not even working that well is imposed top-down by the same irresponsible, unaccountable, self-declared stewards who issued it. Such hubris results in a map that distorts the actual territory because without accurate perception you cannot orient yourself or function properly.

Aenean Money must be an accurate map. The challenge is therefore to design a ‘digital commodity’, a money that can travel anywhere fast, contain and carry value, and yet remain anchored to physical reality through real-word cost.

Ushering in a New Age

Aenean Money certainly sounds utopian, the challenge insurmountable. And yet… we might already have it. Bitcoin is the first and only cryptographic digital bearer instrument that:

Has all of the characteristics of money: durability, divisibility, fungibility, portability and scarcity.

Has the properties deemed necessary by the Austrian School of Economics.

Performs the three functions of money almost flawlessly:

Fixed supply means you know your quantity in proportion to the whole (perfect store of value),

Transactions are uncensorable (perfect medium of exchange), and

You can measure all other goods, anywhere with it (21 quadrillion units), albeit being volatile because it’s young.

Is gaining momentum every year (necessary for a covenant & constitution)

But most importantly, it also meets the criteria outlined above for Aenean Money. Those that will allow it not only to replace Faustian fiat, but push us forward into a more ascendant and vital future.

Here’s how Bitcoin solves the problems I just discussed. I encourage you to read, especially if you’re skeptical.

Bitcoin is internet-native cash

Bitcoin’s declared mission is to be a peer-to-peer digital cash system.

For this it must be a bearer asset, as mentioned earlier, which in Bitcoin’s case is achieved through cryptography: cryptographic key pairs (public and private keys) mark ownership, so that whoever controls the private key (somewhat similar to a password) controls the monetary units while the public key is used to know where you’re sending money (more like an email address). You derive your public key from your private key, but it’s mathematically impossible to go the other way.

Bitcoin is obviously digital, but on top of that it wasn’t created by or for a specific country or economic zone: it is open to the entire world, to whomever wants to use it. That makes it neutral, an ideal tool for both competition and cooperation on a planetary scale. It does not depend on centralized institutions, but is 100% peer-to-peer.

Third parties can exist (service providers like exchanges or custodians) but they are not required. Monetary units can go from one user directly to the other and all that’s needed is a way to broadcast the transaction to the rest of the network. No borders, no limits, no business hours, no bank holidays; on 24/7, 365 days a year.

Not relying on third-party institutions also means that, by default, it is up to the user to safeguard their private key because whoever controls it is the absolute owner of the units. No appeal can be made to intermediaries, and losing or revealing the keys effectively means losing one’s funds. Hence why shared custody solutions with reputable institutions (like physical gold vaults), already exist and are growing – but come with their own trade-offs.

Finally, unlike cash, Bitcoin is not anonymous, since every single transaction – as well as the sending and receiving addresses – are public (see why below). That being said, it is pseudonymous and can be used privately if you avoid tying personal information to the transaction when you acquire the coins or dispose of them. At the end of the day, transactions are associated with an address that’s simply a string of characters. You can use Bitcoin as privately or as publicly as you wish (and there are plenty of tools for both).

Bitcoin is a protocol

Bitcoin is not just money – most fundamentally (and in order for it to be money) it is a protocol. Even more practically, it is software that you run on a computer (‘node’); not just you, but anyone else who wants to. Each node is running a copy of the entire history and chain of transactions (known as the blockchain).

The Bitcoin blockchain records every transaction between users, organising them chronologically in blocks which are then validated (‘mined’) at average intervals of 10 minutes. ‘Miners’ compete to add the next block of transactions to the chain in exchange for a fee paid by the sender and an additional ‘block reward’(more on this below).

Bitcoin nodes communicate with one another and independently verify each and every single transaction to make sure there aren’t discrepancies or foul play, and that everyone is playing the same game. This is why the blockchain is open for all to see, which precludes the need for centralized auditing mechanisms (which are single points of failure: easily corrupted and infiltrated).

Every node runner is therefore an auditor of the Bitcoin blockchain; if you don’t want to trust others with verifying your own transactions, it’s as simple as downloading the software and running it on a machine. Like with privacy, you have the option (not the obligation) to be as sovereign as you want.

What you’re executing when you run the program is a set of rules known as ‘consensus rules’ – the most famous being the 21 million units supply cap. If you run them you are running Bitcoin; but since it’s open source software, you can access the code and change it at will (say to increase the supply and thus inflate the currency). Just be advised that you’d no longer be running Bitcoin, but your very own version which, most likely, no one else will want to run (e.g. BitcoinCash, BitcoinGold, etc). This means you have removed yourself from the game and thus rendered yourself impotent in relation to Bitcoin; which will keep going as long as there are people – somewhere, anywhere – willing to run those original rules.

In other words, the security model of Bitcoin lies in its openness coupled with the very human challenge of social consensus – NOT in encryption! This is hard for even technical people to get their heads around because all other technologies have traditionally relied on obfuscation. Because anyone can run it and anyone can change it, but changing equals self-selecting OFF the network, Bitcoin the protocol cannot be “hacked.”

Finally, since there is no central computer dictating the rules of Bitcoin (they are decided by consensus, by which version node runners agree to run, and enforced by each node individually), that also means there is no issuer of the coins. New units are ‘issued’ by the protocol itself on a predetermined and transparent schedule, and are unlocked by miners as rewards for mining new blocks (more on this below).

Therefore the Bitcoin blockchain acts as a source of truth: it reflects all past transactions verified by consensus and, since that record is inalterable (you would have to alter it in every single node which hosts a copy), it acts as the foundational text all players agree to follow. The strength of this foundation only grows as new participants join until escape velocity is reached. Any other copy of Bitcoin is simply not Bitcoin, regardless of emotional claims and marketing ploys. Consensus is consensus. The network is the network, and Bitcoin achieved escape velocity somewhere between 5 – 8 years ago. The cat is out of the bag & the genie is out of the bottle.

Bitcoin is a network

Because Bitcoin is software, it can technically be updated – although as described above, it is hard to achieve the necessary consensus to apply the changes. But Bitcoin is open source software, so anyone can contribute solutions to problems as they arise – that in itself makes it very adaptable, as any change in the technical landscape can either be absorbed into the protocol or effectively – and relatively quickly – dealt with.

The best example – and one which has far too many people worrying far too much – is the arrival of quantum computing: if it lives up to the hype, traditional encryption may become compromised, so that means Bitcoin will die, right? Well… no: check out this response.

Quantum-proof encryption is being worked on as we speak, since it isn’t just Bitcoin that would be affected, but everything else – airlines, energy grids, banking, military secrets, etc. It’s pretty obvious that as soon as such encryption becomes available, the Bitcoin network will readily adopt it by establishing a new consensus. There will be a messy transitional phase, from one consensus to the next, riddled with debates, forks of the protocol and endless controversy… but eventually, the dust will settle, a new consensus would arise as the new source of truth and – tick tock, next block – the chain would keep doing its thing. There will of course be significant chaos in the interim, but it’s clear that the more pressing the issue faced by the protocol, the faster consensus will be achieved. Far too many people – and that number will only increase – have a considerable stake in the health of the protocol to simply let it die.

Even with this adaptability, the Bitcoin protocol itself remains extremely conservative and change-averse. The main operational issues it has – it is relatively slow and expensive to transact in it – are features not bugs. Bitcoin’s base chain is a settlement layer – like a granite foundation, upon which abstracted layers of any kind can be built. One such layer is the Lightning network, which allows for virtually costless micropayments (of as little as 1/100 millionth of a Bitcoin) at the speed of light. Many others are and will be developed, all the while the base layer remains for final settlement and large transactions that require guaranteed finality.

Beyond that, the protocol itself is also equipped to respond to other kinds of exogenous technological developments like compute or encryption breakthroughs with what is perhaps the most elegant feature of the “bitcoin complex system”: the difficulty adjustment. The difficulty of mining a block algorithmically adjusts roughly every two weeks depending on the computational power deployed by miners: the more power, the harder finding a new block is. This ensures that the next block is always probabilistically ten minutes away from being mined, turning the blockchain into a regular beating heart for economic activity regardless of the changes in computational technology. More on the difficulty adjustment later, and in particular how it defends against catastrophe.

Users play the Bitcoin game in the first place because they know and agree to its fixed rules: the ‘mining’ of new coins – which will end in the year 2140 – is algorithmically scheduled, happening as each new block is mined and confirmed by the network (right now the supply rate is 3.125BTC per block). That supply rate is cut by half every four years – an event called the halving. Right now, thanks to this pre-programmed decreasing supply, Bitcoin is already scarcer than gold. And most importantly, everyone knows how many coins will be mined per block in each halving era.

Now there is some theoretical risk. Bitcoin developers could be bribed, or malicious actors could infiltrate the developer group to place their own agents there, to try and game Bitcoin to their advantage – yes, developers can propose changes and threaten to ruin the delicate balance of incentives that makes the protocol work, BUT… the code is open for all to see, and ultimately it is up to node runners to individually decide whether to update and run the newer version or not. As even the earliest and most influential Bitcoiners have discovered, trying to change Bitcoin is a dangerous game. More than likely you’ll just end up ostracized and ridiculed.

Granted: ignorance, lack of vigilance, mass manipulation through well-orchestrated campaigns… all of these could lead node runners to adopt a malicious version. But the important fact remains that it’s the node runners who are sovereign, not the developers. This gives the currency an almost unprecedented degree of decentralization and therefore resilience – one comparable only to language and similar organic social institutions. The result is that you cannot ban Bitcoin – you can only ban yourself out of it.

Finally, even if a majority of node runners jumped aboard a bad version of Bitcoin… it is highly unlikely all of them would. As long as there is still a network of nodes somewhere running the good version, and as long as someone is incentivized to mine (ie; the network still has some value), then Bitcoin survives. It may lose a lot of value as capital moves away from it, but it will still be functional, thanks in large part to the difficulty adjustment.

The goal is not perfection. That’s impossible. The goal is antifragility, and Bitcoin is about as antifragile as it gets. Just as China, the USG and any other government or institution that has tried to ban or shut it down. Even in the case of natural disaster, or if a large chunk of the network of nodes goes dark, it is extremely unlikely that every single node on Earth will disappear. This is also why it is incumbent on all of us to further fortify the network’s decentralization by running a node. Fun fact: the company Blockstream even broadcasts Bitcoin data from geostationary satellites in space, allowing node runners to sync up without internet access. If you’ve imagined a catastrophic scenario, chances are some Bitcoiners with a high stake in the network’s resilience have already thought about or implemented a solution. This is the power of skin in the game.

Bitcoin is energy

What follows truly is what makes Bitcoin money: not just another cool, nerdy project.

For anything to be money it needs to be tethered to reality through real cost – fiat is the cautionary tale here. So how do you make a bunch of digital 1s and 0s costly? The answer is as simple as it is brilliant: through upfront energy expenditure.

To mine gold you need to expend large amounts of energy. Gold is actually not that rare; its ‘scarcity’ – or its ‘high stock-to-flow’ – is economic (relative), not physical (absolute) and is mainly due to the difficulty and cost of its extraction and processing. What limits the flow of new units of gold into the market is not technological impediments or true scarcity, but profitability: when demand for gold rises significantly, mining companies increase their operations as they become more profitable, since the price per unit has grown.

Besides, technical advances may further reduce the scarcity of gold as we begin mining asteroids. It is not impossible that we soon witness similar influxes of new gold as when the Spaniards conquered the New World. This would cause massive global monetary inflation if we were to have returned to a gold standard.

Bitcoin’s design imitates gold in that so-called ‘miners’ harness real-world energy to solve complex computational problems (essentially finding a predetermined random number); the one miner to find the correct number ‘mines’ a block containing user transactions which is then added ‘on-chain’ in sequence with the last mined block. There is one key difference, which I’ll explain in a moment..

The reward for mining blocks is twofold: (a) all the fees from the transactions collected in the block and (b) the new coins unlocked from – or ‘mined’ out of – the remaining supply which, as mentioned above, occurs at a predetermined and transparent rate.

There is therefore a true economic incentive for miners to expend as much computational power as possible to increase their chances of mining a block, which when taken together creates a condition where the collective energy expenditure of all honest miners (it pays to mine only valid transactions) is greater than any one miner alone. In other words, it means that all miners effectively contribute their energy expenditure to the network. This is actually why blocks containing prior transactions cannot be retroactively altered. It’s not because of some “magical” property of a blockchain, but specifically because it is prohibitively expensive to do so. Bitcoin’s uncensorability and resistance to change is unique because it is by far the most expensive to influence or alter, and there is no way to fake said influence other than to burn energy via compute. It is therefore as real as it gets.

Now…that one important difference I mentioned earlier, between mining gold and mining Bitcoin, is related to the difficulty adjustment I outlined in the prior “Bitcoin is a network” section. This may indeed be one of the most elegant feats of engineering since man made the wheel.

When Bitcoin’s price rises, miners’ incentive grows and thus they increase their operations (deploy more energy); yet the difficulty adjustment also rises on par with the amount of new computational power deployed. This results in blocks still being mined every ten minutes, which in turn ensures that Bitcoin’s supply schedule remains known and predictable – a source of truth.

If the price decreases, however, the incentive is lesser for big players; BUT (and this is really where the magic happens) since the difficulty of the problem to solve in order to mine the next block is also reduced, mining new blocks becomes more accessible to smaller players. In other words, there will always be someone willing to expend the relevant energy to mine some amount of Bitcoin.

Therefore, no matter how much Bitcoin’s price rises, it’s not possible to mine more Bitcoin, and no matter how much it falls, the same predetermined amount is issued by the network for someone to mine and accumulate. This inelasticity creates both volatility (which can be extreme at times) and opportunity (which is also extreme), especially while Bitcoin is young (anything less than 50 years old).

Bitcoin is not easy to understand, really. It takes a considerable amount of studying because it is such a fundamental paradigm shift, such a departure from anything we’ve known. It also demands experience: you can’t really be convinced no matter how strong the argument, you’ve got to hold it for at least one epoch (the span of time between two halvings) to really feel its properties.

Bitcoin is unique

The final and most underrated element of Bitcoin is its uniqueness. Bitcoin is not only special because of all the reasons outlined above. It is special because it is a one time event. It is a zero-to-one moment.

It’s easy to confuse Bitcoin – with its blend of technical properties and incentive architecture – with ‘crypto’, which may share a couple of characteristics, namely cryptography, a blockchain and a token of some sort. But the truth is, these elements alone are not what make Bitcoin unique. What makes Bitcoin unique is the blend of all these factors, and the very social and human element of consensus (which has reached escape velocity) and path dependence – in other words, you can copy all of Bitcoin’s technical attributes, but you cannot go back in time and plant Bitcoin in 2008, when nobody believed it would be a thing, and have it grow the way it did, organically, absent a key man to drive it.

As such, there is nothing in the world quite like it. Every other crypto-currency is in some way tied to a centralized institution (a company or a foundation), all with very fallible, very human CEOs or directors at the top. None of them have proven impervious to manipulation. None harness the computational power, and therefore energy-backing as Bitcoin. None will ever be trusted as a truly neutral protocol, because they cannot be.

It is key to differentiate and discriminate. I have tried to lay out carefully not only the properties but the values that Aenean Money must represent. Such monetization events are extremely rare in history.

The final aspect – indeed, one of the most crucial ones – of Bitcoin is the circumstances surrounding its creation and launch into the world. An anonymous programmer (or group of them) going by pseudonym Satoshi Nakamoto worked on Bitcoin in secret until he finally announced it in a mailing list for other nerds. Then, after seeing to its development for a couple of years, Nakamoto simply vanished (as the roughly 1M Bitcoins to his ‘name,’ which to this day remain untouched, show). This is known among ‘Bitcoiners’ as Bitcoin’s Immaculate Conception. You may smirk at the pomposity… but they do have a point, and that is something that no crypto will be able to replicate, no matter how hard they try.

What Bitcoin is today can only be explained by the way it was ignored, allowed to do its thing unimpeded for years, and by the succession of events that led to its current position: its success is to be explained by path dependence, and it’s extremely unlikely that the exact same circumstances and events will happen again in exactly the same way.

All of that gives us one final condition for Aenean Money: Mythos. Satoshi, whoever he was, left us with something groundbreaking. The man, the myth, departed and now, it is our responsibility to pick up where he left it, and carry the torch into the future.

Bitcoin is Aenean Money.

What If

Now… I know what some of you are thinking: “But what if…”

So allow me to indulge the thought.

What if a catastrophic scenario befell the network where the mining industry collapsed, and with them, naturally, the value of the coin. Chaos would ensue… for some time.

But, as I said above, as long as there are a few nodes still running the same version of the blockchain, Bitcoin survives. Tick tock, next block.

Depending on how bad it got (perhaps a global blackout), maybe no new block would be mined for a while: no one would be able or willing to expend the energy required to mine a block of heavily depreciated money. Still, a mere two weeks after the disaster, the difficulty adjustment would kick in and drop the energy requirements to such a level that anyone could conceivably mine a block using negligible amounts of energy, perhaps even on their laptop. This of course presupposes that humanity comes out the other end of the disaster with enough access to energy once more.

But even in a worst-case scenario, where humanity was plunged into darkness for a prolonged period of time, the Bitcoin blockchain would remain dormant, waiting to be revived when energy comes back online and the need for money re-emerges. It may not be the first choice of money. Perhaps gold is preferable initially; but in time, as the grid and connectivity come back, so too will the need for a “digital energy money” – and what better option than the one with the entire historical record and the available infrastructure?

At the end of the day, holders are incentivized to maintain the network, even if their holdings have decreased in value. So long as two nodes are running the network, the fundamental properties of Bitcoin remain. By mining their own blocks, they would be able to transact and record their transactions. In time, because it retains both properties and history, others would see the value in it again, demand would increase, the price would go up; the mining incentive would become more attractive; competition would increase, and so the amount of energy deployed in securing the network; the difficulty adjustment would increase also, driving competition and specialization and further securing the network; which increases the value captured in each unit; which in turn is reflected in the higher Bitcoin price, and the greater opportunity-cost of missing out…

And so, while it would probably take a while – the first time around it took a few years to kick off and about a decade to really become unstoppable – Bitcoin would ultimately come alive again. This extreme resilience makes it exceptionally useful and therefore valuable – not only in economic terms, but in civilizational terms.

The Aenean Future

Credit: @PabloPeniche on X.

While I am convinced that Bitcoin will be key in moving us beyond the Faustian fiat paradigm, I am also realistic as to its scope: if we do build a new civilization and enter a new age, Bitcoin will likely not travel with us to the stars.

Bitcoin does have predictable and specific limitations. The speed of light is one such limitation, and stellar distances simply preclude the protocol from ever becoming inter-planetary. Bitcoin’s center of hash – a sort of center of gravity weighted by the hash power of all miners contributing to the network – will always remain on or close to Earth. This will put miners at planetary distances at a consistent disadvantage compared to Terran ones, because the time required to transmit information back to Earth will be greater than the block time of 10 minutes. Mars for example is just beyond the “hash-horizon” - the following diagram is from a great article explaining exactly why:

In short, Bitcoin is unlikely to follow us as we colonize new systems. But this is fine: Bitcoin's role is to usher in the Aenean Age.

When we finally colonize Mars, and enter the Martian Age, we will have to launch a new coin, one that exists on Mars alone – likely some kind of Musk coin as a homage to the man. In the same way, Titan will have its own coin, and any other far-flung region we inhabit.

Framing Bitcoin in this way – as bound to a specific role, time and place in History, and understood within reasonable boundaries – makes sense, as opposed to the happy-go-lucky mentality of some people. It is a more Aenean mindset, one which recognizes that things and people have their time and their place, and that no one solution can fix all the problems forever.

Maybe Aenean Man will not really establish the new civilization and age – after all, it wasn’t Aeneas who founded Rome, but his descendants. Aenean Man may, thanks to a sounder money in the form of Bitcoin, carry the national and family gods out of the smoldering ruins of the old city, across the sea and onto a new land, where eventually a new civilization will arise. The Aenean Age may be but a transition phase, Aenean Man a pilot navigating the stormy seas of the Interregnum. And with Bitcoin as the North Star, the ship may just make its way to new shores…

My name is Aleksandar Svetski. I am a writer, entrepreneur and serial Substack reader. If you’ve enjoyed this article please drop a comment and consider subscribing to my Substack The Remnant Chronicles. You can also find my book The Bushido of Bitcoin on Amazon. (You can check out the trailer below.) Thanks for reading.

This smells of sophistry. While doing an admirable job of delineating the desirable characteristics of sound money, it is, at best, misguided to advocate for Bitcoin. Do you expect people to jump on board with a digital, not physical, currency created by a mysteriously anonymous figure, a digital construct that has miraculously been left unscathed by the many assaults on other digital currencies, that is mentioned off-handedly by government officials as a potential future vehicle for them, and that relies on the magical blockchain encryption that data indicates has already been compromised? It is a shame to have laid out such a wonderful framework for sound money, only to reach such a flawed conclusion.

As economist Richard Werner describes, ordinary credit, created by banks, is perfectly capable of propelling economic growth. What matters is how the money is allocated—asset purchases, consumption credit, or business investment.

https://youtu.be/IzE038REw2k?t=363

The existence of credit renders a currency's nominal immutability moot.

The implicit assumption in the bitcoinist thesis is that hard-capped money, in other words, radical monetary austerity, is somehow more beneficial for the economy than the ability to fund multiple business ventures with the same dollar.