Last week, in an uncharacteristic moment of optimism inspired by the red wave that swept across America, I announced the dawn of a new civilization - one based on what I call the Aenean soul, the successor to the Faustian soul that has animated the West from the Renaissance until now.

But, in truth, the new civilization has not yet dawned. We remain in the twilight of the Faustian age. And in these darkening hours, the West faces a confluence of crises, some proclaimed loudly by environmentalists, others muttered in shadowed corners of boardrooms, and still others dismissed by those who believe tomorrow must always resemble today.

These crises are rooted in resource depletion, and they threaten to collapse Western civilization long before it can achieve its Aenean destiny. The prophets of decline—be they neo-Malthusians or the stewards of the Club of Rome—warn of limits that cannot be ignored.

The Faustian soul denied that such limits existed except in the minds of doomsayers. The Aenean soul acknowledges the limits but aims to overcome them with courage and wisdom. This article is my effort to make that acknowledgment and assess the challenges we face.

Do not yield to misfortunes, but advance more boldly against them.

Energy: The Lifeblood of Industry

Western civilization’s ambitions have been powered by energy—first muscle, then firewood, then coal, and then oil. Despite advances in nuclear and renewable power, fossil fuels remain the dominant energy source of the modern era (providing 81.5% of total energy). Yet while demand for energy is practically infinite, fossil fuels are painfully finite.

Globally, the proven reserves of oil are estimated at 1.57 trillion barrels. At the current consumption rate of 100 million barrels per day, these reserves will last just 47 years. Natural gas reserves total 7,200 trillion cubic feet. At the current consumption of 132 trillion cubic feet annually, these will last about 50 years. Coal reserves are the most abundant at 1.2 trillion tons. With consumption at 8.56 billion tons annually, there is supply for 137 years.

Another way to consider our energy reserves is to translate the volume of fuel into BTUs of energy. Oil yields 5.8 million BTU/barrel, so 1.7 trillion barrels yields 9,860 quadrillion BTU. Natural gas yields 1,037 BTU/cf, so 6.85 trillion cf yields 7,110 quadrillion BTU. Coal yields 24 million BTU/ton, so 1.2 trillion tons yields 28,800 quadrillion BTU. Global energy consumption per year is 600 quadrillion BTU. From that perspective, if we assumed single source energy consumption, there is enough to sustain us for 16.4 years using oil, 11.85 years using gas, and 48 years using coal, or 76.25 years total. Since fossil fuels are 81.5% of total energy usage, we can say we have about 93 years total in which we can power our civilization with fossil fuels.

Now, techno-optimists have rightly pointed out that “proven reserves” is quite misleading. Despite ever-growing consumption, the amount of reserves has tended to remain steady, or even grow, over time. Worldometers offers these useful illustrations:

Unfortunately, the apparently steady state of proven reserves is also misleading. It ignores the decline of energy return on energy investment (EROEI). The fossil fuels that are in reserve today are far harder to access than the fossil fuels that were in reserve 10 years, 20 years, ago, or 50 years ago.

The decline in EROEI is easy to see when we review what energy costs. Today, oil trades at $65–75 per barrel, natural gas at $3 - $5 per thousand cubic feet, and coal at $120 - $140 per ton. In 1970, prior to the onset of the energy crisis, the inflation-adjusted price of oil was around $26 per barrel; of natural gas, $2 per thousand cubic feet; and of coal, $38 per ton.

To understand how these costs translate into energy generation costs, we must examine the energy content of each fuel and calculate their dollar cost per kilowatt-hour (kWh).

Oil contains approximately 5.8 million BTU per barrel, translating to about 1,700 kWh per barrel. At $65 to $75 per barrel, the raw cost of oil equates to 3.8 to 4.4 cents per kWh. In 1970, prices were 1.5 cents per kWh.

Natural gas, with an energy content of approximately 1,037 BTU per cubic foot, yields about 304 kWh per MCF. Thus, at $3–$5 per MCF, natural gas costs 0.98 to 1.64 cents per kWh. In 1970, prices were 0.65 cents per kWh.

Coal, boasting an energy density of around 24 million BTU per ton (7,032 kWh/ton), costs 1.71–2 cents per kWh when priced at $120–140 per ton. In contrast, in 1970, the prices were 0.54 cents per KWh.

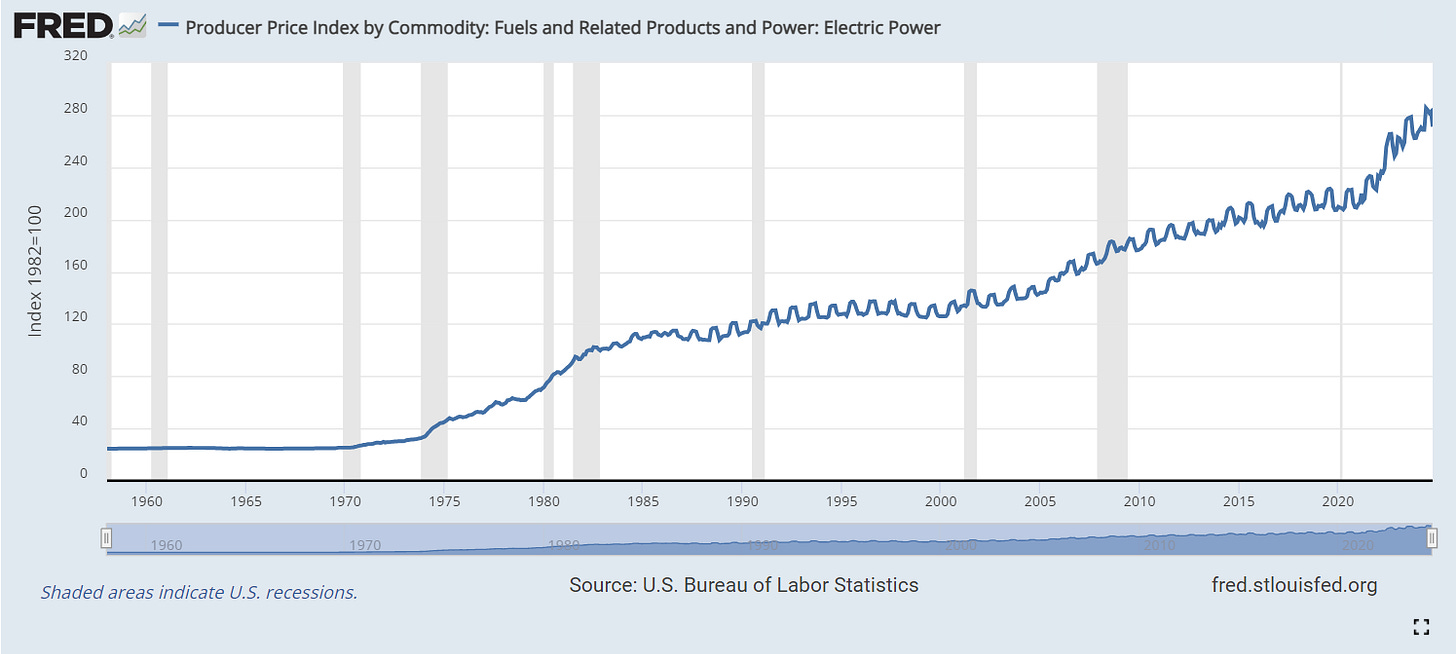

These prices reflect not growing abundance or steady supply but increasing scarcity: the diminishing returns of extraction of ever-more-inaccessible reserves. Each drop of oil, each cubic foot of gas, and each lump of coal takes more energy to extract than its predecessors. The Federal Reserve Economic Data (FRED) Producer Price Index for Electric Power, below, presents the data in a stark visual.

We are not merely consuming fuel; we are consuming the infrastructure of modernity itself. If Aenean civilization cannot tap new sources of energy, it cannot sustain our current cosmopolis, let alone seek out the cosmos.

Rare Earth Metals: The Bottleneck of Modern Technology

Beneath the skin of every electric vehicle, the magnet of every wind turbine, and the circuitry of every smartphone lies a foundation of rare earth metals—materials so indispensable that their absence would collapse entire industries.

Global reserves of rare earth elements are relatively small. Neodymium, vital for permanent magnets in electric motors and turbines, is found in quantities of 8 million tons. Dysprosium, essential for strengthening these magnets under extreme conditions, is even scarcer, with just 1.5 million tons. Terbium, used in high-performance magnets and phosphors, is rarer still, with reserves of 0.5 million tons.

The United States holds 2.3 million tons of these metals, concentrated in California and Alaska. Yet this domestic supply is dwarfed by the dominance of China, which controls 70% of global production and 85% of refining capacity. Extraction is not merely a matter of digging into the earth but of enduring the environmental consequences: refining rare earths generates 1.2 tons of radioactive waste per ton of material.

Costs further reflect the strain of extraction. Neodymium commands $150–200 per kilogram, dysprosium $300–400 per kilogram, and terbium $600–700 per kilogram. These prices are not arbitrary but a reflection of the energy-intensive, polluting, and politically fraught process required to extract them.

And these prices have been going up, up, up as demand grows faster than supply. According to the Columbia Climate School’s State of the Planet report, “global demand for neodymium is expected to grow 48 percent by 2050, exceeding the projected supply by 250 percent by 2030. The need for praseodymium could exceed supply by 175 percent. Terbium demand is also expected to exceed supply.” Without these materials, our dream of an Aenean future collapses into ash.

Industrial and Strategic Metals: The Infrastructure of Civilization

The infrastructure of civilization is composed of iron, copper, nickel, cobalt, and lithium—each playing its role in the processes of production that maintain our way of life.

Iron, the most important metal on earth, has 190 billion tons of reserves. Global iron ore consumption is 2 billion tons, giving us a 95-year supply.

Copper, indispensable for electrical systems, exists in global reserves of 880 million tons. Annual demand is 28 million tons, leaving a 31-year supply.

Nickel, vital for aerospace alloys and batteries, is estimated at 130 million tons. Global consumption is 3.1 million tons annual, for a reserve of 41 years.

Cobalt and lithium, the lifeblood of modern batteries, have reserves of 8.3 million and 98 million tons, respectively. Global cobalt consumption is 216,000 tons while lithium consumption is around 1 million tons. That suggests a 37-year supply of cobalt and 98-year supply of lithium.

These numbers suggest abundance, but appearances deceive. As with our fossil fuel reserves, the abundant and easy-to-access reserves are already gone and what remains is increasingly harder to get. For instance, declining ore grades mean that each ton of copper extracted today requires 16% more energy than it did 20 years ago.

Since the cost of energy to extract ore is also increasing at the same time as the cost of energy is increasing and the demand for ore is outstripping supply, costs are escalating at a geometric rate. (As much as 50% of the cost of metal is the cost of the energy needed to extract it!)

In 2000, iron ore was priced at approximately $29 per dry metric ton unit (dmtu), and by 2023, it averaged around $120 per dmtu. In 2000, copper was priced at about $0.84 per pound, and by 2024, it reached approximately $4.09 per pound. Similar trends are visible in every other strategic and industrial metal. Absent Aenean innovation, these prices will rise and rise and rise as demand accelerates and supply dwindles.

Agriculture: The Foundation of the Food Supply

In the 1960s, a chorus of doomsayers, spurred by the burgeoning environmental movement, warned of an imminent era of global starvation. Paul Ehrlich’s The Population Bomb encapsulated the prevailing anxiety, predicting mass famines as humanity outstripped its ability to produce food.

Yet these grim prophecies were thwarted—not by a reduction in population growth, but by the advent of the Green Revolution. This agricultural transformation, driven by innovations in crop genetics, chemical fertilizers, and mechanized farming, fed billions and defied the grim arithmetic of scarcity.

Corn yields grew 223% from approximately 55 bushels per acre in 1960 to 177 bushels per acre in 2024. Soybean yields grew 130% from 22 bushels per acre to 50.6 bushels per acre. Rice yields grew 139% from 3,200 pounds per acre to 7,649 pounds per acre. Potato yields grew 141% from 250 hundredweight per acre to 459 hundredweight per acre.

Now, however, the very system that once forestalled starvation is itself under siege. Depleting soil, dwindling resources, and the ecological toll of decades of intensive agriculture threaten to undermine the Green Revolution's gains.

Because of population growth, the once-expansive bounty of arable land is dwindling. In 1960, the world offered 0.37 hectares of cultivable soil per capita. Today, that figure has plummeted to 0.19 hectares, and by 2050 (when humanity's numbers are projected to swell to nearly 10 billion) it is expected to collapse to a mere 0.15 hectares. Note that the reduction in per capita arable land from 1960 to 2024 required yield per acre to double simply to keep the population fed and that yield per acre must increase by another 26% over the next 25 years.

The highly intense continuously-cultivated monocropping used to achieve these yields rapidly degrades the soil. According to the UN's Food and Agriculture Organization (FAO), soil is being lost at 10 to 40 times the natural replenishment rate.

Nitrogen, phosphorus, and potassium fertilizers compensate for depleted soil nutrients, providing plants with essential inputs directly. However, as soil degrades, the amount of fertilizer required to maintain high yields on soil tends to increase.

Nitrogen: In 1960, the average nitrogen application rate for corn was approximately 40 lbs/acre; today, the current rate is 150 lbs/acre. For wheat it has grown from 30 lbs/acre to 90 lbs/acre, and for rice from 30 lbs/acre to 100 lbs/acre.

Phosphorous: In 1960, corn was treated with 20 lbs/acre of phosphorous, today with 60 lbs/acre; wheat with 15 lbs/acre and 30 lbs/acre; soybeans with 10 lbs/acre and 20 lbs/acre; and rice with 15lbs/acre and 40 lbs/acre.

Potassium: In 1960, corn was treated with 20 lbs/acre of potassium, today with 70 lbs/acre; wheat, 10 lbs/acre and 30 lbs/acre; soybean 10ls/acre and 20 lbs/acre; and rice 10 lbs/acre to 40 lbs/acre.

Phosphorous and potassium are relatively abundant, with 74 billion tons and 3.8 billion tons available respectively - enough to last for over a century. Nitrogen is even more abundant, as it comprises 78% of our atmosphere. However, atmospheric nitrogen (N₂) is inert and must be converted into reactive forms usable by plants. This conversion is achieved through the Haber-Bosch process, which synthesizes ammonia (NH₃) from atmospheric nitrogen and hydrogen derived from natural gas. Approximately 1.5 to 1.6 metric tons (150,000 cubic feet) of natural gas gets consumed per metric ton of ammonia produced.

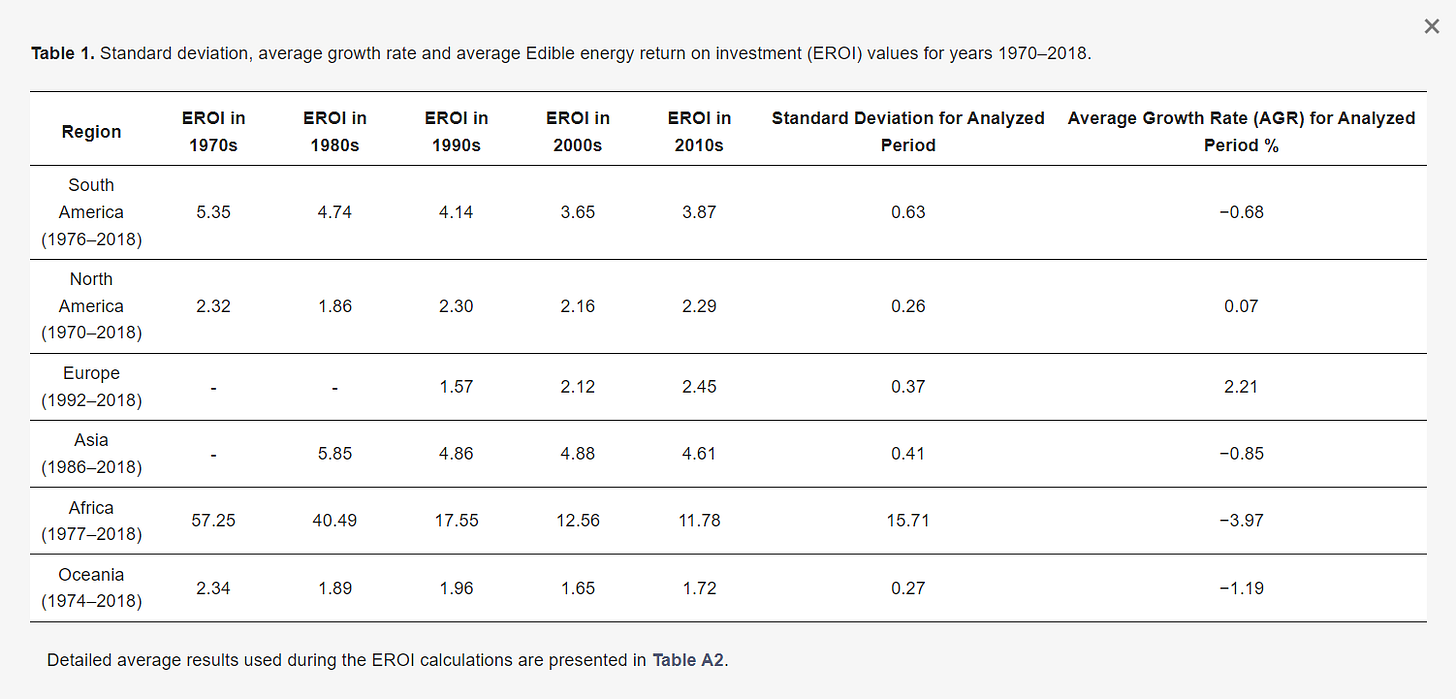

In addition to the direct input of natural gas into ammonia, all of these fertilizers require energy to extract and utilize, and of course the armada of tractors, trucks, and other vehicles and machines that make modern agriculture possible also require energy to manufacture and operate. Direct and indirect energy consumption in agriculture (e.g., the use of energy for the production of fertilizers, pesticides or agricultural machinery) can be compared to the energy returned in the form of calories (edible energy) to assess edible energy return on investment (EEROI).

In most regions of the world, EEROI has been steadily dropping by a half-point per year as arable land is depleted and ever-increasing energy is allocated to make up for nature’s exhaustion. Since that energy itself is also suffering from decrease EROEI, the problem is once again geometric.

Europe, however, has enjoyed an increase in EEROI of 2.21% per year. Environmentalist organizations assert that that this improvement has been driven by Europe’s adoption of resource-efficient farming methods, precision agriculture technologies, renewable energy integration, and localized production. If so, that suggests a Neo-Green Revolution might be possible. For the Aenean dream to manifest, it has to be.

Water: The Lubricant of Life

While the scarcity of energy, metal, and arable land tends to dominate headlines, the supply of fresh water may pose a greater problem in some regions of the world.

Global freshwater withdrawals total 4,000 cubic kilometers annually, with agriculture consuming 70% of that. Per capita freshwater availability has decreased by 68% from 17,200 cubic meters per year in 1950 to 5,400 cubic meters per year in 2024.

Water scarcity is already reality for 2.3 billion people. The problem is primarily driven by population growth - but we are, of course, heading into an era of depopulation. Nevertheless overextraction and pollution have diminished the usable freshwater to a thin margin that could easily evaporate if the Earth entered a warm period, be it natural or anthropogenic.

If water does become a problem, there is a solution: desalination. However desalination requires vast amounts of energy, on the order of 4 kilowatt-hours per cubic meter. How much energy is that? Well, if we imagine some calamity occurred that forced us to use desalination for all of our freshwater, it would require 16,000 TWh of energy. For comparison, the total global electricity consumption in 2021 was approximately 27,000 TWh. Desalinating enough water to hydrate all of humanity would require nearly 60% of the world’s current electricity production.

At present, neither of the Aenean regions (America and Europe) faces an imminent, systemic water shortage comparable to fuel crises. Specific regions, particularly in the western U.S. and southern Europe, are grappling with some water stress, but these challenges can be mitigated with investment in technology, infrastructure, and efficient management.

Credit: The Expenditures of the Past, Payable in the Future

If credit is a resource then the West, America in particular, has depleted its credit supply far more than it has depleted its supply of anything else. The staggering accumulation of unpayable debts across households, corporations, and governments is historically unprecedented outside of wartime. The U.S. national debt hit $36 trillion while I was drafting this article.

At this point, any left-leaning economists among you are already beginning to type lengthy comments explaining that credit isn’t a resource in the same way that, say, iron or oil is a resource. Credit is just an entry in a balance sheet, a mere social construct that we can create it at our keyboards. America can never run out of credit because it can print its own money!

Sadly, the economists among you are wrong. Credit is denominated in dollars but it is materialized as a claim in real goods or services. And real goods and services are, by definition, finite. A society can produce only so much food, so much energy, so many homes, and so many gadgets within a given timeframe. When credit expands far beyond the capacity of a society to meet these claims with actual goods or services, the gap between financial promises and material reality grows untenably wide. This is not a theoretical observation; it is a historical pattern.

We see the consequences of such mismatches every time a credit bubble bursts. The boom times of easy money—when everyone can buy a house, a car, or a business on leveraged credit—inevitably give way to a reckoning. Debt repayments outstrip the value of what was produced. Lenders panic, borrowers default, and the promises of the financial system evaporate into thin air. What remains is the unyielding reality of limited resources.

When this happens at the scale of a single sector—such as housing in 2008—the effects are devastating but containable with sufficient intervention. But when it happens at the scale of an entire society, no intervention is sufficient. The mismatch becomes existential. In modern America, the proliferation of debt signals not just a misalignment between financial promises and economic capacity but also the Faustian failure to confront the limits of growth.

The conceit that "credit is infinite" rested on an unspoken assumption: that the productive capacity of the economy can always expand to meet the needs of its debts. Historically, this assumption worked well enough during periods of technological and demographic expansion. The Industrial Revolution, for instance, unlocked new ways to extract resources, produce goods, and power economies, allowing debts to be paid through increased growth.

But in the 21st century, economic growth has slowed dramatically in developed nations, and much of the low-hanging fruit of technological innovation has already been harvested. Meanwhile, environmental constraints have grown tighter. The credit that America has conjured over decades assumed a future of Faustian growth that is no longer plausible for our current civilization.

When credit exceeds the capacity to produce, inflation is one way that the system attempts to rebalance itself. By devaluing money, inflation effectively erases some of the claims on real goods and services, ensuring that fewer of these promises can be fulfilled. In small doses, this is manageable, even expected. In large doses, it destroys trust in the currency itself. Hyperinflation, the extreme form of this phenomenon, is not just an economic collapse but a collapse of the social contract.

This is why credit must be understood as a finite resource. It is not infinite because trust is not infinite. The value of credit depends on the belief that promises will be kept. When promises are made on an unrealistic scale, trust erodes. When trust erodes, credit becomes worthless, and the economy regresses to barter or subsistence.

A civilization that burns through its trust is doomed to collapse just as much as one that burns through its oil and gas. The Aenean leader must find a way to solve the credit crisis or he will not be able to solve any of the others.

The Problems Interlock to Create a Dilemma

These problems cannot be understood in isolation, for they are interlocking and interdependent. We cannot sustain industry without replacing fossil fuels as our primary energy source. We cannot replace fossil fuels without an enormous capital expenditure requiring inputs of industrial metal and rare earths. We cannot get more industrial metals and rare earths without massive expenditure of fossil fuels.

The dilemmas compound further in agriculture. A reduction in fossil fuel consumption limits the production of fertilizers and the operation of mechanized farming equipment, which in turn lowers crop yields. Lower yields mean higher food prices, potentially destabilizing societies already strained by economic inequality. Attempts to mitigate this by investing in superior agricultural practices demand yet more rare metals for precision technologies, renewable energy for electric tractors, and water management infrastructure, drawing heavily on already scarce resources.

Water, too, connects to every other crisis. The extraction of fossil fuels, mining of rare earths, and production of industrial metals all consume vast amounts of freshwater. Without adequate water supplies, energy production falters, mining grinds to a halt, and agriculture collapses. Desalination, while a potential solution, requires immense amounts of energy, which brings us back to the declining EROEI of fossil fuels and the limited capacity of renewable systems.

Credit is the thread that binds all these dilemmas together. Without affordable credit, the investments needed cannot occur. Yet credit itself is constrained by the diminishing returns of our physical economy. The Faustian illusion that we can indefinitely defer payment to the future has led us to this impasse: a moment when all paths forward require sacrifices that the present system is ill-equipped to bear.

The challenges of the present moment are immense — perhaps even insurmountable. Yet we must surmount them. The Aenean soul must not flinch in the face of adversity; it must rise to meet it.

If we succeed, we will pass through the threshold. The future will not merely be a continuation of the past but the birth of something greater. In the words of Virgil: forsan et haec olim meminisse juvabit — “perhaps someday we will look back on even these trials with joy,” for they marked the dawn of the Aenean age.

Perhaps woe… is the path to woah.

Uh oh I'm getting ratioed, 28 likes and 38 comments on my own essay

110 ❤️ versus 121 comments...

Pater Nooooo! 😅