World War Next

A game designer's look at the relative strength of America, China, and Russia

War is coming. Maybe not this month, maybe not this year, but it’s coming. The Pax American has ended. The men and women who remember the horror of World War II are long gone. The taboo on violence has been lifted. War is coming. You can disagree, but I have a ham radio set up at my desk, and when the missiles start to fly, I will radio you to say “I told you so.” (Leave your callsign in the comments.)

If war comes, will the US prevail? Our national mythology holds that we’re always the good guys and the good guys always win. But war is the province of blood, steel, risk, and grit, not myth. The United States has not faced a hot war against a peer adversary in 77 years. It has not faced a hot war against a peer adversary capable of attacking its home soil in 157 years. Since that time, we have grown in population and gross domestic product, but we have also deindustrialized and offshored much of the capability that once made us “the Arsenal of Democracy.” In that same time, a new adversary has arisen, the first we have ever faced that has a larger population and economy than us.

Let’s explore what the next world war might look like, if the US, China, and Russia come to blows. This is a complex topic, so it might end up a multi-part series.

A Brief Statement of Credentials

War is a serious mater, and an armchair strategist who wishes to be taken seriously should state his credentials. Here are mine, for good or ill. (You can skip this paragraph if you don’t care.) I planned on a career in the military and attended the US Military Academy at West Point from 1993 to 1995, where I was in the top 5% of my class academically and was adjutant of the Wargames Club. Sadly, I was at the bottom 1% of my class physically, which rather dampened my prospects for a career. After my hopes and dreams were crushed at West Point, I became a military history major at Binghamton University, where my final project was a simulation of hypothetical Middle Eastern conflict in 2001. From there I co-wrote the modern warfare game Modern Spearhead, which was the first microarmor rules set to simulate the differences, not just in NATO and Warsaw Pact equipment, but in their maneuver, fire control, and doctrine. MSH has been played for many years at the USMA Wargames Club and around the world. I have since also written Domains at War, a simulation of ancient and medieval warfare. I have also consulted on a number of defense-related projects, most recently in 2019 when I served as a panelist at the US Army War College workshop Wargaming A.I.: Exploring First Principles to Simulate an Advanced, Artificially Intelligent Military Command and Control System. My analysis is thus going to be that of a wargame designer, perhaps a very good wargame designer, but not that of a scholar or veteran.

World War Next Will Not Be Short

Virtually every public discussion of World War III scenarios, and the vast majority of WWIII fiction, assumes that WWIII will be very short. The assumption seems to be that one side or the other will quickly gain the upper hand, the other side will then threaten to use nuclear weapons to end the conflict, and the hot war will end with some sort of negotiated armistice to avoid global annihilation.

I believe this notion is terribly mistaken. Prior to the outbreak of every major war, the strategists on both sides are virtually always confident that the next war will be short. “You’ll be home for Christmas, boys!” Whether we look at the American Civil War, First World War, Korean War, Iraq War, Afghanistan War, or the most recent Russo-Ukraine War, we see that wars always last much longer than the pre-war planners expected.

In a short war, the winner will tend to be whichever side has better-trained and better-led troops with better equipment. The Americans excel at this. So did the Germans. Unfortunately, wars don’t tend to be a short.

In a long war, the winner will tend to be whichever side is willing and able to sustainably deploy “good enough” troops with “good enough” equipment in large quantities for long periods of time. In short, it will be whichever side can mobilize for total war.

Measuring Might: Mobilization

The greatest mobilization in human history occurred during world War II. In 1940, the US spent 4% of its GDP on national defense; by 1945, it spent almost 40%. Similarly, in 1940, the USSR spent 10% of its GDP on national defense, but increased it to 65% by 1944.

Today, Russia spends 4.1% of its GDP on its military; America spends 3.5%; and China spends 2.1%. (Saudi Arabia, at 10.4%, and Israel at 5.2% are the two biggest spenders by ratio.) They are essentially on pre-war footing, demobilized.

To what extent could today’s superpowers match the mobilization of the WWII-era US and USSR?

According to the Center for Economic Policy Research (CEPR), about one-third of military spending is on personnel. The remainder is on equipment and operations, both of which are highly demanding on the economy’s manufacturing and energy sectors. At the outbreak of World War II, manufacturing and energy accounted for approximately 30% of the American GDP. From that basis, America spent 40% of its GDP on war. As a first approximation, therefore, the maximum extent to which an economy can be mobilized for defense spending might be 133% of its manufacturing and energy GDP.

At present, manufacturing and energy make up 41% of China’s GDP, 30% of Russia’s GDP, and 20% of America’s GDP. Therefore, the maximum mobilization we would expect their economy to achieve would be 54% for China, 40% for Russia, and 27% for America.

Wait, you ask — Why can’t we just “build more factories?” Because it’s very difficult to rapidly grow manufacturing. The fastest large-scale improvement I have found in looking at data is a 3% increase in the share of manufacturing per year for a major economy. Achieving this during wartime, when manpower is diverted into uniform and infrastructure is under attack seems unlikely. A nation can rapidly convert its peacetime manufacturing to wartime manufacturing, but it cannot rapidly build manufacturing capability where none existed. I assume that maximum mobilization might increase by at most 1% per year from their present level.

Even when taking advantage of pre-existing industrial infrastructure, mobilization is never instantaneous. In its best year, the US was able to mobilize from 10% to 35% (1941 to 1942), and the USSR was able to mobilize from 20% to 55% (1942 to 1943). That suggests the absolute best possible mobilization is a 3.5 increase annually. It’s not clear to me that any of today’s great powers could match those, due to the vastly increased complexity and fragility of our supply chains. Therefore I assume that actual mobilization can at most double yearly, until the maximum mobilization is reached. Therefore I estimate the following:

In one year, America could achieve 7% mobilization; in two years, 15% mobilization; in three years, 30% mobilization; in four years 31%; in five years 32%.

In one year, China could achieve 5% mobilization; in two years, 10%; in three years 20%; in four years 40%; in five years 60%.

In one year, Russia could achieve 8% mobilization; in two years, 16%; in three years, 33%; in four years 44%; in five years 45%.

Now, in considering what mobilization as a percentage of GDP means, we need to be sure we are comparing apples to apples. A comparison of nominal GDP won’t do. At a minimum we need to use Purchasing Parity Power (PPP) adjusted GDP. But even that might understate the relative capabilities.

In a July 2017 white paper by the Heritage Foundation called “Putting Defense Spending in Context: Simple Comparisons are Inadequate,” the authors found:

For the equivalent investment in terms of U.S. dollars, China and Russia respectively have 1.7 times and 2.5 times the purchasing power within their domestic markets… Due to differences in purchasing power across economies, then, two countries could hypothetically field the same size and quality force at dramatically different spending levels.

For example, the Chinese Yuzhao-class landing platform dock (LPD) costs approximately $300 million to build and is most similar in terms of displacement and capability to the U.S. San Antonio-class LPD. However, the purchase price of the San Antonio-class LP exceeds $1.6 billion per unit…

In the March 2015 article “China’s Military and Growing Political Power,” the CEPR notes:

Using exchange rates comparisons significantly understates the Chinese military spending. A much more realistic assessment is obtained using PPP terms… China’s military budget was 18% of that of the US using market exchange rate comparisons, but 33% of the one of the US using PPP exchange rates…

The correct exchange rate with which to compare military spending would be a price or unit cost ratio of military services in each country… We use market exchange rates as a measure of relative military equipment costs facing each country... For relative operations costs, however, we use PPP exchange rates as a reasonable proxy… Finally, relative personnel costs are obtained using manufacturing wages, either gross or net of on-costs, since this represents the social opportunity cost of military employment.

This low relative military costs exchange rate implies a real value of China’s military spending of 40% of the US in real terms – larger than the level implied by using PPP rates of 33%, and much larger than the market exchange rate based figure of 18%.

Thus the best estimates are that in relative terms, we have to scale up China’s GDP by (40%/18%) = 220% in order to get an accurate picture of its potential mobilization. Unfortunately CEPR did not provide a similar ratio for Russia, but we can approximate it by multiplying Russia’s PPP multiplier (250% of nominal GDP) by (40%/33%) = 120%, for a total multiplier of 300%.

I have tabulated this in the table below, to gives us a rough picture of the real mobilization capabilities of today’s great powers at this moment.

This is not a pretty picture if you like the Star-Spangled Banner. China’s military-effective GDP is already almost 200% the size of America’s military-effective GDP, and its effective military spending is 130% of our own! Meanwhile, Russia — currently mocked in the mainstream press as an economic weakling — is maintaining an effective military budget of 30% of America’s. Given that the US tries to maintain military power across the entire globe, while Russia only needs regional dominance, this should make us very uneasy about our relative capabilities.

It gets worse when we consider mobilization over time. Much, much worse. US deindustrialization has virtually crippled our large-scale mobilization, while China has become an Arsenal of Authoritarianism. Below I have tabulated each nation’s expected Mobilization Ratio and used that to calculate its Effective Military Spending (EMS) per year of World War Next.

The longer the war goes on, the worse it looks for America. In year one, America is able to spend 64% of China and Russia’s defense budget. By year five, America can only spend 26% of its rivals’ defense budgets.

Measuring Might: Combat Effectiveness Value

As I mentioned earlier, in a short war, the winner will tend to be whichever side has better-trained and better-led troops with better equipment. Most analysts believe that American armed forces are, today, better-trained, better-led troops with better-equipment than our rivals. But how much better?

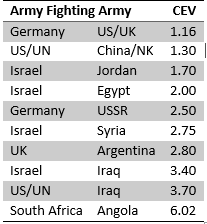

The 20th century military theorist Colonel T.N. Dupuy developed a method of quantitative analysis of combat outcomes by which he measured the “combat effectiveness value” of military units of different nations in mid-century wars. In his article Technology and the Human Factor in War, published in Vol 2. Number 1 of the International TDM Newsletter, Colonel Dupuy analyzes the combat effectiveness values (CEV) of troops in several historic conflicts, including Germany vs. the USSR in World War II; Germany vs. the West in World War II; Israel vs. Arabs in 1948, 1956, 1967, 1973 and 1982; Britain vs. Argentina in the Falklands 1982; South Africans vs. Angolans and Cubans, 1987-88; and the US vs. Iraq, 1991. He does not provide data for the US and UN vs. North Korea and China, 1950-1953, but I’ve used his methods to calculate that CEV.

Below I have tabulated the combat effectiveness values for the various armies. Where the armies have fought multiple times, I’ve averaged the results. The data are presented with the more effective army in the first column, the less effective army in the second column, and the actual relative CEV in the third column.

According to Dupuy, the greatest disparity in troop quality in any 20th century war was the 1987-1988 war between South Africa and Angola, where each South African soldier was worth 6.02 Angolan soldiers. The closest to peer-on-peer quality was in the Western front of World War II, where each German soldier was worth 1.16 Allied soldiers.

Since our Effective Military Spending levels have already accounted for structural differences in cost-effectiveness of spending, they can serve as a good proxy for the amount of manpower, munitions, and vehicles each side can deploy. Therefore, we can get a more accurate picture of each side’s warfighting capabilities if we multiply their Effective Military Spending (EMS) levels by their Combat Effectiveness Values (CEV). Let’s call this product of EMS x CEV their Combat Power. A 3:1 advantage in Combat Power can be considered decisive.

Unfortunately, assessing the appropriate CEVs is not easy. America has not fought a conventional hot war in 20 years, and China has not fought one in 69 years. The Russians are fighting one now, but the details of the Russo-Ukraine are blanked in misinformation that make it difficult to parse. Therefore below I offer a series of Combat Power comparisons assuming a range of CEVs.

Case 1: Near Peer

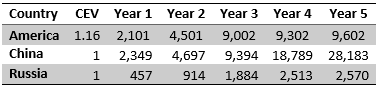

In our first (worst) case, we assume that America has the same limited advantage over Russia and China that Germany had over the US and UK in World War II. America has a better army, but it’s up against essentially peer-level adversaries.

Here we see that America begins with slight military inferiority to China and Russia, but likely can defend itself for the first three years of total war. By Year 4 China has twice as much combat power, and by Year 5 it has three times as much. The US does worse here than Germany did in WWII. We start losing immediately and eventually suffer total defeat.

Case 2: Iron Eagle

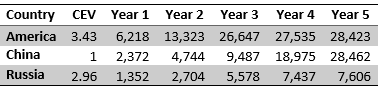

In our second case, we assume that America has the same advantage over Russia that Israel had over Egypt (CEV 2.0), and the same advantage over China that UN forces had over China (note that 2/1.53 = 1.3).

Here we see that America begins with military parity superiority over China and still almost parity even with Russia added in. It can maintain its position for the first three years of total war. By Year 4, however, China’s industrial capacity has given it a 1.5:1 advantage in combat power, and by Year 5, China' has a 2.7 advantage. This case is very similar to what we saw in World War II, with Germany apparently winning in 1940, 1941, and 1942, becoming outgunned in 1943, and then decisively overpowered by 1944-1945.

Case 3: Paper Dragon

In our third case, we assume that China is something of a “paper dragon,” with a poorly-trained army that hasn’t fought a real war in many years. We give America the same advantage over China that the US had over Iraq (CEV 3.4). However, we assume that Russia’s battle-hardened army is quite good, so America’s relative CEV is only 1.16 towards them.

Here America has a 2:1 superiority in combat power over both China and Russia for the first two years of the war, and maintains parity through Year 4. Even in Year 5, at total mobilization, China is only at parity with America, and even with Russia cannot achieve a decisive 3:1 advantage. This case is likely to end in either a quick victory for America if it defeat one adversary at a time early one; otherwise, it’ll end in a negotiated armistice.

Case 4: Steel Bear

In our fourth case, we assume that Russia’s military is actually superior to that of America when the war breaks out, perhaps because of experience under fire in Ukraine or depletion of US supplies in the same. Either way, we give it a CEV of 1.16, the same advantage that Germany had over America in WWII. We assume that China, absent from total war for so many decades, is not very effective, with America enjoying a CEV of 2 over it.

In this case, America enjoys substantial military superiority through Year 3, then becomes somewhat outgunned in Year 4 and Year 5. Notably, Russia is a very important factor in the first two years of the war, much more than it is in the other cases. If I were designing an Axis & Allies style commercial wargame, I might choose to use case 4 for the game, simply because it would for the most dramatic and entertaining game for all the players involved.

Unfortunately, World War Next is more likely to become a war before it becomes a wargame. And in none of our hypothetical wars do we see America certain to win.

Contemplate this on the Tree of Woe.

A truly terrifying analysis!

I recommend that we all stop referring to Communist China, and start referring to National Socialist China, because that's closer to what they are.

I want loopholes! And so I will try some nitpicks, not out of any sense of personal competence in this area, but just looking for less woe.

---

The business of switching from manufacturing consumer and commercial goods to making war machines has changed dramatically from the Roosevelt days. Military contractors tend to be more dedicated to doing just military stuff than in days past. In the US the mindset for military contracting is completely alien to the market world because the federal government is both purchaser and investor. (I have seen this personally, as I used to be in that world.)

The US of the 1930s was super peacetime. Recall the Kellogg Briand pact, and how pacifist the American Right was. On the other hand, we had mothballed a lot of industrial capacity due to the Great Depression. Today, military equipment is what supports the US dollar as you have pointed out in past posts. This might be an anti loophole!

On the gripping hand, we have some capabilities mothballed from the Cold War days. And we have a vast reservoir of potential factory labor and cannon fodder in the form of able bodied welfare recipients and tough guys twiddling their thumbs in jail. There are also many mothballed factories on the civilian side from our policy of Subsidized Outsourcing.

Finally, America has grown mighty soft. But if war becomes existential, we could harden up substantially. If we accept that casualties are going to happen, we could take a more Total Quantity Management approach to fighter planes, for example. We could offer military service as an alternative to prison for street toughs, like we did in the old days. We could give drill sergeants real power to punish for such recruits. We also have a vast reservoir of illegal immigrants. A policy of Go Fight or Go Home would give us a foreign legion real quick.

But could we transition fast enough? Or could we recruit real allies in time, say a remilitarization of Japan or an official alliance with Vietnam?

---

Yes, I am grasping at straws.

Fascinating piece. I agree with your conclusion that a manufacturing economy beats a service economy when mobilizing for war. Factories beat out burger flippers and retail space. Someone should inform the neocons in Washington. This is the first analysis I’ve seen that takes into account the kind of GDP as opposed to the level of GDP. I also think your analysis of the relative effectiveness of military spending is interesting. The difference in cost between a Chinese aircraft carrier and a US one is startling. It also seems that some of our high-level military people are very focused on issues not related to preparing to fight. It’s my understanding that other militaries concern themselves with being able to achieve military objectives.

A few questions:

• Much of your examples involve older conflicts or conflicts between non-nuclear powers. Doesn’t the possibility of a war going nuclear change the strategic calculations?

• I’m also curious about your thoughts on the location and aims of a conflict on your projected outcome.

o A US invasion of China might be impossible. Besides a huge geography and huge population, my understanding is they have hypersonic projectiles that can sink an aircraft carrier. No idea how we’d land.

o I can’t see how invading Russia would work due to the size of the place, the weather, and their nuclear stockpile. How do we maintain supply lines?

o I also don’t see how China or Russia could invade the US and occupy it. Even putting aside our nuclear arsenal, the country is 3,000 miles wide by 1,000 miles long with varied terrain and half a billion guns. The only way that works is if the communists in our government succeed in disarming the population prior to an invasion. FWIW, a former Presidential National Security Advisor I know thinks a substantial portion of US corporations, the media, and many of our government officials are already on the Chinese payroll.

• If we’re not contemplating an invasion of the homeland, then where’s the conflict geographically?

o The US can tie Russia up in Ukraine for a while. Both countries got caught in Afghanistan forever and know how to fund an insurgency against the other side. This assumes Europe can go without Russian gas and the world can go without Ukrainian wheat.

o I spoke with a former high level military officer and Presidential military advisor who thinks the US can defend Taiwan. I’m skeptical we can/would bring enough firepower to China’s border on what they consider to be an existential issue. Plus, what happens to Taiwan Semiconductor and a tech-enabled world that can no longer get the best computer chips in the world.

o China is busy getting much of South America on its side, but they seem more interested in colonizing Africa than invading S. America.

• I’m also curious about your thoughts on non-military warfare

o The Chinese already own our media and all mass communication is filtered to fit their preferred narrative.

o My understanding is the US can pull chip designs that TSMC needs and stop high-level manufacturing. But if anyone destroys those plants or stops them, I think our military might be in trouble. Not sure how much we get from TSMC and how much from Samsung, but those are the best chip-makers in the world.

o I also think most of our military equipment relies on foreign semiconductors including all missile guidance systems. As much as I’m a free market guy, I’d pay TSMC to build plants here and hand out green cards to everyone who works there from the engineers to the janitors.

o China makes 90% of our pharmaceuticals. We used to make them in PR, but someone in Congress thought they could get more taxes from the pharma Cos. and they all moved production to China. The Chinese can turn off the spigot and kill grandma (along with everyone with a heart or cholesterol problem). How much of our population is currently on anti-depressants? That level of withdrawal all at once would be startling - not to mention people who have other urgent medical conditions.

o The Russians have shown an ability to hack our electrical grid and could possibly take it down. My understanding is that we could harden the entire system for a few billion dollars which is irrelevant in the grand scheme of things, but no one has shown an interest in doing so probably for the Thomas Sowell reason – politicians get no credit for spending money to prevent the thing that didn’t happen.

o No idea what US capability is for non-military warfare, but the US and Russia probably have the best hackers in the world. Strange to think the whole thing could come down to a newly found backdoor in someone’s military access. Kind of the 2022 version of the enigma machine.

Just my thoughts for the day. Again, thanks for the great article.