A Lens to Understand the Trump Tariffs

A Guest Essay by Gary Brode from Deep Knowledge Investing

This week’s essay is by my friend and collaborator Gary Brode, director of the research firm Deep Knowledge Investing. He and I have been discussing setting up a premium Substack called “Tree of Knowledge” (or maybe “Tree of Knowledge of Weal and Woe”) for deeper dives into finance and trading. If you’d be interested in that, let us know in the comments!

Hello Woe readers. I’ve been fortunate enough to collaborate with Alex on prior pieces including writing a Deep Knowledge Investing Part IV to his excellent Running on Empty series. In that article, we recommended dealing with the problem of a continually debased dollar by buying lots of Bitcoin, some gold, and a little silver (among other thoughts). That’s worked out well. Alex was also kind enough to ask me to write the forward to the book version of Running on Empty, and I was happy to add my thoughts on what I thought was an incredible piece of economic and historical analysis.

The big news in the financial markets over the past couple of weeks has been tariff threats and discussions. I recently read an apt description of how people interpret President Trump. It’s said that his detractors (the press) take him literally but not seriously while his supporters take him seriously but not literally. I believe the second interpretation is the correct one. To that end, many of the discussed tariff threats are not actually about a desire for tariffs; but rather, an attempt to gain cooperation or compliance on unrelated issues.

Deep Knowledge Investing is focused on helping our subscribers make money in the stock market so much of my analysis is time-sensitive. However, since tariffs are likely to be a significant area of discussion over the next four years, I think it’s useful to provide a lens on how we think they should be interpreted. As always, with issues tied to international relations, my views will evolve based on new news and events.

I also feel the need to provide a trigger warning for my fellow Woe readers. Unlike many economists, market strategists, and the Wall Street Journal, I don’t think President Trump is about to destroy the economy. As a result, my views are not as pessimistic as this publication prefers. You have been warned that the world is not about to come to an end, so read on at your own risk!

Trade is Great – Not All Tariffs Are Bad

In college, I learned about Porter’s theory of comparative advantage. It says that we’ll all be better off if countries produce what they’re best at producing and trade with each other. It makes sense, and throughout history, empires and fortunes have risen based on access to trade. In the east, China benefitted from its Silk Road. Rome prospered for many reasons, but access to trade routes and building a massive road system was a meaningful contributor. England built a worldwide empire on the back of the world’s best navy and domination of shipping lanes and trade. Finally, it’s no coincidence that the financial capital of the United States is New York City, a place with unusually deep shipping ports. Miami, Boston, Los Angeles, and San Francisco all have various specialties, but shipping and access to trade helped put them on the map.

All of this is great on paper, and most of the time, it’s good in practice as well. Unfortunately, it’s a problem for much of the US right now. Our manufacturing base and high-quality blue-collar jobs have been hollowed out. This is leading to declining quality and length of life in much of the country as the US outsources manufacturing to places with a lower cost of labor. To maintain the dollar as the world’s reserve currency means we need to run trade deficits and supply the world with dollars they use for their own trade. The impact of this has been to make part of the US very wealthy and part of the country destitute.

Losing our ability to manufacture is not only a quality-of-life issue but also, a national security one. We are not capable of building ships in quantity. Both military and commercial aircraft quality, and the ability to produce new models of planes on time are declining. It takes longer for us to build skyscrapers now than it did 80 years ago. Despite multiple presidential administrations of both parties talking extensively about improving infrastructure, our bridges, roads, and railroad tracks aren’t improving.

We’ve yet to see the trillion dollars of “shovel-ready” projects President Obama promised us in 2008. In 2016, Candidate Trump told us if elected, our new airports he would build would be the envy of the world. Neither happened, and I don’t think it the fault of either President Obama or President Trump. Our permitting and approval process is so convoluted that it’s impossible to start a project in a 4 or 8 year presidential term, let alone finish one.

Of greater concern to me are the things we don’t and can’t make here. The entire world now runs on computer chips. While Nvidia and AMD are American companies, they don’t manufacture here. Intel has had issues with its last two generations of processors which kept burning out due to too much voltage delivered to meet ever-greater processing needs. Their “fix” is to limit the voltage which means for two years Intel customers have been paying for performance the chips couldn’t reliably deliver. (I’m hoping the new Core Ultra line will address this problem.) The best chips in the world are made in Taiwan by TSMC. Taiwan is a US ally right now. TSMC is a valuable partner right now. Taiwain is hoping the “silicon shield” prevents a Chinese takeover. China has made it explicitly clear that they WILL take Taiwan at some point and do so by force if necessary. I believe China will sacrifice TSMC as an asset if that’s the cost of fulfilling their vision of reunifying China.

Other top manufacturers include Qualcomm and Samsung. The machines needed to produce the ultra-high-end chips do “extreme ultraviolet lithography” and are only made by ASML Holding. Simply stated, the only high-end domestic chip manufacturer the US has is Intel, and right now, the company lags its competition. Whether you want to make appliances, cars, airplanes, weapons systems, or develop artificial intelligence, the US does not currently have the capacity to do so without help from other countries. That’s fine right now, but it’s not hard to imagine future scenarios where that becomes a national security and quality of life disaster.

The US used to manufacture its pharmaceuticals in Puerto Rico. Some “smart” people in Congress didn’t like the idea of big pharma getting tax breaks so Congress eliminated them. The result wasn’t more money flowing to Washington DC; but rather, our pharmaceutical manufacturing moving to China. During Covid, we needed to rely on China for our protective equipment which was of inconsistent quality. If you want to argue with me that the classic model of trade means we should always buy from the foreign low-cost producer, you’re welcome to do so, and I will understand your point of view. I’m still going to point out that if we can’t make semiconductor chips, pharmaceuticals, ships, or protective equipment, maybe we need to reconsider the model.

There’s also a lot of indeterminate speculation on the inflationary impact of tariffs. The data on that isn’t clear to me. There are arguments that the great depression was caused by tariffs and counter-arguments that tariffs weren’t the issue. During President Trump’s first term, the inflation index that measures producer prices (the costs which eventually make their way into the Consumer Price Index) didn’t rise. It’s possible to argue we had a different economy then and that China successfully ignored and evaded some tariffs. One argument I find compelling is that tariffs may be inflationary initially, but because they incentivize increasing domestic supply, that increased supply can prevent further price increases. Whether any future Trump tariffs are inflationary or not will depend on levels and implementation details that have not been determined at this time. (Again, my apologies to the Woe readers who understandably prefer a more consistently negative message!)

Will President Trump’s tariffs address these issues? It’s impossible to tell right now. He hasn’t been clear on what his exact tariff plans are. Some of those plans are for actual tariffs. Others are negotiating points to get concessions in other areas. Finally, like almost all government policies, whatever does get announced and implemented will have unintended consequences.

Tariffs Aren’t Always About Tariffs

While many economists are wailing about the threats to free trade, it’s important to recognize that President Trump doesn’t always want tariffs. He uses the threat of them to gain compliance on non-economic issues. We had an event two weeks ago that illustrates this point perfectly.

Colombia

When Colombia refused to accept repatriation of their own citizens. President Trump responded by threating a 25% tariff on Colombian products scheduled to rise to 50% one week later. Within hours, Colombia agreed to the repatriation of all Colombian citizens in the US illegally including on US military aircraft. The President of Colombia issued some threats of his own, but quickly agreed to all US demands and at one point, offered to send his personal plane to pick up his citizens.

Canada and Mexico

We got a second example of the Trump tariff approach last week. The President rocked markets late in the day on Friday and over the weekend by insisting he was going to implement 25% tariffs on our neighbors, Canada and Mexico. Those tariffs were put on hold for a month when both countries offered what appears to be meaningful assistance and cooperation in preventing the flood of people and fentanyl illegally entering the US through our shared borders. I believe the reason President Trump put the tariffs on hold rather than cancelled them is because he wants to ensure actual cooperation and compliance. He’s decided border security is going to be a shared issue and not solely a US-problem.

The EU

Potential European tariffs are a likely third example of this approach. Many Europeans are worried that discussed tariffs on the EU would have a harmful effect on their economy. I think Trump is following his usual plan of threatening tariffs to get other concessions. With Russia and China becoming closer allies, and the BRICS coalition attempting to challenge the dollar, it is not in US interests to try to crash the EU economy!

The most likely issue on the table would be NATO funding. Many European countries spend less than what they’ve agreed to spend on their defense budgets. This leaves President Trump and many Americans with the opinion that the US is subsidizing European defense, and that Europe isn’t living up to their agreements as part of NATO. This was a subject of much discussion during President Trump’s first term. Could he stop threatening tariffs if EU countries commit more to their defense budgets?

There are also areas where European governments subsidize their own companies and industries that compete directly with US companies. Airbus subsidies irritated Boeing for years and Boeing regularly complained about an uneven playing field. I’m not hearing a lot of talk about these kinds of company or industry-specific issues, but they have arisen in the past and could be part of a future deal. I’ll also acknowledge that there are industries where the US subsidizes its own companies or has high-priced supply deals which could be seen as an indirect subsidy. Any uneven playing field allegations can be pointed in multiple directions.

Closing Non-Reciprocal Trade

There are exceptions to my above lens, and sometimes, President Trump does want tariffs. Other countries have become expert at using the US press to complain about tariffs and a perceived lack of access to the giant US consumer market. Many of these complainers have in place substantial tariffs and other regulations which restrict access by the US to their markets. Despite having the world’s second largest economy, China is still taking advantage of its developing nation status at the World Trade Organization. Many Americans find this lack of reciprocity in our trade relations to be galling. President Trump is one of them. Some of the loudest countries trying to exit the dollar system also have the largest trade barriers in place.

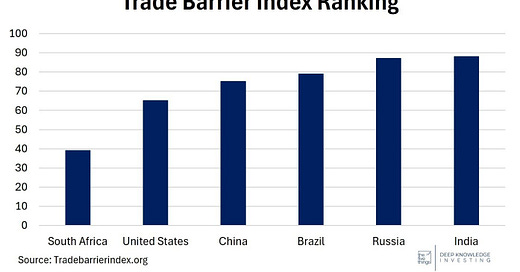

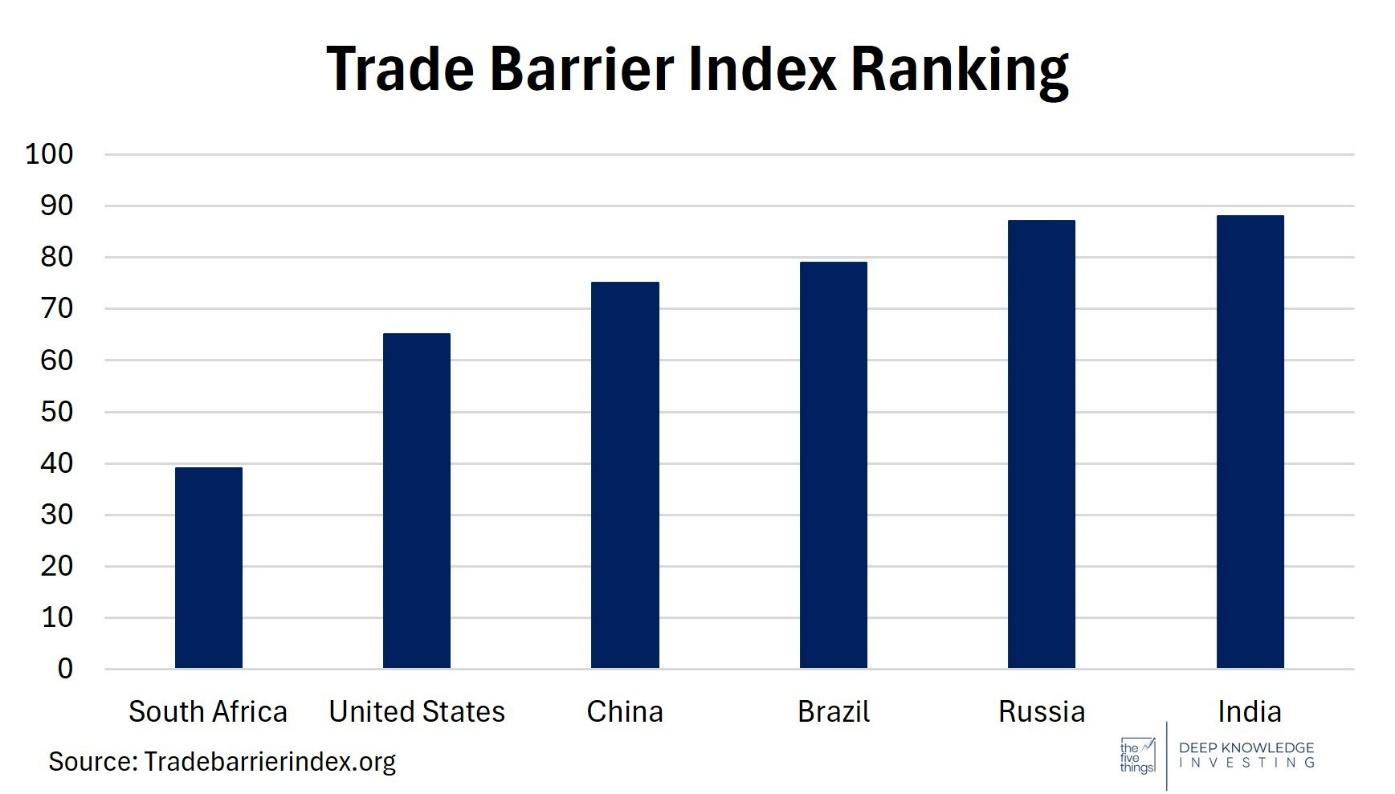

The US is no angel in this category, but many of the countries complaining are less open to our products than we are to theirs. Data from tradebarrierindex.org. Higher is worse. Russia and India at #87 and #88 out of 88 countries listed.

Kill Equities to Save Bonds

You may have seen this expression lately. The thinking is that the US is facing a debt crisis. We are in full Ponzi scheme mode as we now print dollars to pay the interest on dollars we printed last year. On-balance sheet debt is now over $37 trillion with deficits of $2T - $3T a year. DOGE spending cuts can’t get here fast enough. (A side note: I was skeptical of the ability of DOGE to make significant spending cuts. Early efforts there have exceeded my expectations. I wish them well in cutting government waste.)

To make matters worse, previous Treasury Secretary, Janet Yellen, shortened the duration on US bond refinancings when rates were low and she should have done the opposite. Now, as the yield curve has un-inverted by raising the yield demanded for longer-term Treasuries (called a bear steepener), the US faces a need to refinance ever-greater amounts of debt at higher rates.

Because they encourage buying domestically and discourage buying foreign products, tariffs generally cause the dollar to strengthen against other currencies. In turn, this can lower Treasury yields. The stock market is signaling unhappiness with all of these potential tariffs, but whether the stock market goes up or down, the Treasury needs to refinance more debt and doing so at higher interest rates will crush the budget. (For more on this, be sure to check out my DKI article “Counter-Intuitive Inflation”.) President Trump likes a strong stock market, but his recent public comments have made it explicitly clear he’s willing to endure a certain amount of short-term pain to get the results he wants. Refinancing expiring debt is something that needs to be done.

Update: As I was writing this, there’s increased speculation that President Trump and Treasury Secretary Bessent are using tariff talks to strengthen the dollar. In turn, this is lowering the yield on the 10-year Treasury and giving them the chance to refinance the debt at a more advantageous rate. That would give the Administration additional room for the tax cuts they want. There’s a lot of gamesmanship involved here, but Bessent is clearly a much better option at Treasury than Secretary Yellen was. We’ll be watching future actions and adjusting our thoughts on the matter as events unfold.

The Canadian and Mexican Tariffs May be Aimed at China

When President Trump announced the 25% tariffs on Mexico and Canada, I got a lot of questions regarding his actual motivations. Government officials from both countries said that at this point, they aren’t completely sure what they’d need to do to be in compliance with the wishes of the White House. That may actually be true.

Public comments out of the White House were focused on asking for more help securing the border and a reduction in the amount of fentanyl crossing into the US. These are reasonable requests, but if Canadian and Mexican officials didn’t know specifically what kind of cooperation President Trump wanted, they would be unable to comply. I think it’s likely there’s another issue which is significant, but not being discussed.

During President Trump’s first term, he enacted steep tariffs on imports from China. China evaded a lot of those tariffs by shipping through Mexico, Canada, and one particular Asian country. I think Trump is trying to close that loophole and make it more cost efficient for China to just pay the tariff than to try to evade it. I’m making an inference, not reporting on something I “know”. The elimination of the constantly abused “de minimis trade exemption” by Chinese exporters is additional evidence supporting my speculation. For now, President Trump is indicating that he’s satisfied with border cooperation, but at some point, he’s going to take on China directly. If tariffs on Mexico and Canada come up again at that time, this would be the likely reason.

Conclusion

For reasons Woe readers will understand, the press likes to make it seem like President Trump is a simple man with simple strategies. The truth is much more complicated. Sometimes, he uses the threat of tariffs to compel cooperation on non-economic issues. Sometimes, he uses tariffs to try to level a playing field he reasonably thinks is tilted against US interests. And sometimes, he wants to use tariffs as a tool to restart US manufacturing capacity. Knowing that having a consistent playbook makes it easy for adversaries to respond, he often uses hyperbole and misdirection. This is why I think the lens of “take him seriously but not literally” is the more useful approach than the opposite.

Many economists are busy calculating the economic effect of policies which haven’t been designed, discussed publicly, or implemented. I recommend holding off on the specific analysis until there’s something specific to analyze. I also add the reminder that these kinds of international trade policies often have unintended consequences often making detailed analysis a pointless exercise.

At Deep Knowledge Investing, I work with hedge funds, family offices, investment advisors, and individuals to help them get better returns in the stock market. The recommended portfolio and my personal portfolio are heavily weighted to themes that will benefit from debasement of the dollar (and all fiat), growing energy needs, and individual high-growth stocks in fields that I believe will benefit for the next 5-10 years or more. If that’s interesting to you, you’re welcome to subscribe. I’m offering Tree of Woe readers a 25% discount on yearly and monthly subscriptions through the end of March. Just use coupon code: Woe25

For those of you with questions and opinions, you are always welcome to reach me at IR@DeepKnowledgeInvesting.com.

Information contained in this report is believed by Deep Knowledge Investing (“DKI”) to be accurate and/or derived from sources which it believes to be reliable; however, such information is presented without warranty of any kind, whether express or implied and DKI makes no representation as to the completeness, timeliness or accuracy of the information contained therein or with regard to the results to be obtained from its use. The provision of the information contained in the Services shall not be deemed to obligate DKI to provide updated or similar information in the future except to the extent it may be required to do so.

The information we provide is publicly available; our reports are neither an offer nor a solicitation to buy or sell securities. All expressions of opinion are precisely that and are subject to change. DKI, affiliates of DKI or its principal or others associated with DKI may have, take or sell positions in securities of companies about which we write.

Our opinions are not advice that investment in a company’s securities is suitable for any particular investor. Each investor should consult with and rely on his or its own investigation, due diligence and the recommendations of investment professionals whom the investor has engaged for that purpose.

In no event shall DKI be liable for any costs, liabilities, losses, expenses (including, but not limited to, attorneys’ fees), damages of any kind, including direct, indirect, punitive, incidental, special or consequential damages, or for any trading losses arising from or attributable to the use of this report.

Comparative Advantage doesn't rule out tariffs. We heavily tax domestic labor and equipment. Without tariffs we have subsidized outsourcing, not free trade. For example, a switch to the Fair Tax would be the equivalent to a 30% tariff on all foreign consumer goods.

We did have a protectionist system prior to the income tax. Then, the federal government taxed foreign merchandise at a much higher rate than domestic.

If the combination of income and FICA taxes add up to the same as the tariff rate, importing vs. making it here is revenue neutral.

Some would argue that income and FICA taxes support the workers and businesses which pay these taxes. Partially true. However, when blue collar wages go up, the federal government's welfare burden goes down. Also, the federal government is a major purchaser of domestic labor. By putting too much of the tax burden on domestic labor, the government is taxing itself. This is not sustainable.

In other words, Trump is not protectionist enough. 30% tariffs should be the baseline, with special deals for very close trade partners or poor countries we want to subsidize. (OK, maybe a bit lower since state sales taxes have the same effect as tariffs for foreign made consumer goods. Go for 23%

as the baseline.)

John Gallagher & Ronald Robinson, in their landmark essay “The Imperialism of Free Trade (1953), go over all the considerations that Great Powers make when they reach their zenith & midday & Ipso Facto how such considerations make them pursue ‘Free Trade’ against others.

Relevant: https://www.jstor.org/stable/2591017

Tariffs & Protectionism, meanwhile, are deployed in two instances.

The first is during the Ascension/Growth phase, when said Burgeoning Great Power defends its productive forces, labour pool, etc, from foreign actors trying to seize control of the market using various tactics (such as dumping lots of cheap product & cratering prices).

The second is during the Decline/Demise phase, when the said Weakened Great Power seeks to ‘jolt’ the patient whose heart rate has flatlined on the operating Table. Tariffs in this scenario are more used as leverage to get certain actors (like private enterprise & governments) to BEHAVE a certain way, as opposed to the Tariffs themselves ‘equalizing things on a Dollar per Dollar basis.

Yeltsin’s Shock therapy comes to mind as a more modern example of this, while the ‘Price Revolution’ of the long century & a half decline of the Spanish Empire... is a more Classic case.

Anyhow, it’s a ‘Hail Mary’ which has implicit to it these notions that ‘Actors X, Y & Z will change their behaviour BECAUSE of these Tariffs or these threats’... which alas is Optimistic silliness.

The Truth is that (for instance) even if America puts Tariffs on Canada & gets a significant cash windfall, that is brutally offset & turned red by lower volumes of Canadian Oil reaching American markets. Ditto for many other ‘simple’ & fundamental goods used as cheap inputs in various sectors. Steel comes to mind when considering that ‘US firms that produce steel’ is easily dwarfed by ‘US firms that NEED steel.’ This is now a feature, not a bug.

These pursuits will deindustrialize America at an accelerated pace since many firms will go to alternative markets. Meanwhile, those that stay with the US market will lower volumes & these low volumes will mean the cash windfall turns red in the medium to long term.