Running on Empty, Part I

How the Petrodollar System Restored, Then Ruined, America's Economy

The Russo-Ukraine War has at this point been ongoing for several months. Even if the war were to end tomorrow (which it won’t), it has already had a massive effect on the globe, with food crises, mass migrations, and enormous expenditure of blood and treasure.

The biggest effect of the war, though, is only beginning. America’s global hegemony is based on the petrodollar system and the Russo-Ukraine war is rapidly bringing that system to an end. The end of the petrodollar will be the end of the world order as we have known it since 1945.

Though the U.S. petrodollar system is perhaps the most important economic structure in the world, it is almost never discussed in mainstream sources. Therefore, before I write about the future, I’m going to write first about the past and present. Part I of this series will explain what the petrodollar system is and what its financial effects have been. In Part II, I’ll explain its implications for foreign policy and how that led to the Russo-Ukraine War. In Part III, I’ll explain how the system is breaking down and what might happen next.

The US Dollar is the World’s First Reserve Currency Not Backed By Gold

A reserve currency is a currency that is held by central banks worldwide as part of their foreign exchange reserves.

Reserve currencies arise in the context of international trade. Each country mints and/or prints its own currency, which is legal tender within its borders. When a business sells goods within a country, it is paid for those goods in the country’s currency. For instance, when Apple sells iPhones in Japan, it sells them for yen. This poses a problem for international businesses that sell goods abroad, as they need to be able spend the money they receive at home. From this necessity, foreign exchange arises, where yen can be traded for dollars, dollars for euro, and so on.

The value of a currency, however, can fluctuate sharply. Assuming a steady velocity of trade, the value of a currency is correlated to the quantity of goods and services that can be bought with it divided by quantity of the currency in circulation.

Value of Currency = Quantity of Available Goods / Available Currency

If a lot of currency is minted or printed, the value of the currency falls - this process is called devaluation of the currency. Devaluation can profoundly impact import and export. For instance, if Japan printed a thousand quadrillion yen immediately after Apple completed a new iPhone launch, Apple’s holdings of yen would drop in value. When it tried to swap its yen for dollars, it wouldn’t get many dollars, and it would have thus lost money on its sales. Going forward, Apple would have to raise the price of iPhones. Japanese consumers would see this as inflation.

Devaluation of currency is the primary reason for inflation. (Milton Friedman went further and claimed that “inflation is always and everywhere a monetary phenomenon,” but we don’t need to defend that claim to make our point.) It’s important to note that an increase in money supply doesn’t necessarily lead to inflation, however. If the quantity of available goods increases at the same time, then price levels will stay the same.

Now, history has proven that governments have, can, and do devalue their currencies regularly. And even when it is not intentionally devalued, the value of a currency can drop simply from economic factors. Every business, bank, and nation seeks to hold a currency with a stable value that will be useable for a wide variety of transactions around the world.

And that is the basis for a reserve currency. Every nation feels comfortable buying and selling with the reserve currency, knowing that the currency will always have value to other countries.

How is this happy state of affairs achieved? Traditionally, a reserve currency is established by a wealthy exporting nation and then backed by a precious metal, such as silver or gold. If a currency is backed, that means that a bank or business can swap the currency for a fixed amount of precious metal.

When a currency is backed by precious metal, the government that issues the currency is restricted in its ability to mint or print new currency, and that helps keep its value stable. The financiers transacting in the currency know that isn't just going to hyperinflate like the Zimbabwean money did. You cannot print more gold.

The Greek drachma, which became widespread during Alexander’s conquests, was arguably the world’s first reserve currency. The Roman denarii succeeded the drachma, and was in turn succeeded by (at various times and places) the Byzantine solidus, Arab dinar, French franc, Venetian ducat, Florentine florin, Spanish dollar, and Dutch guilder. Finally, from the 19th century until the middle of the 20th century, the United Kingdom’s pound sterling was the world’s reserve currency. All of these currencies were backed by silver or gold.

The United States dollar is today the world’s reserve currency, but it is not backed by gold. In fact, it is the first reserve currency in history to operate without backing by any precious metal whatsoever. How did this strange situation arise?

At the end of World War II, Great Britain was a debt-ridden and war-weary country, and the pound sterling was no longer capable of serving as the world’s reserve currency. In July 1944, hundreds of delegates from 44 Allied nations gathered in Bretton Woods, New Hampshire, for a 21-day summit to determine (among other things) a new reserve currency. The United States, which held two-thirds of the world’s gold, dominated the proceedings. At the conclusion of the summit, the so-called Bretton Woods System was put in place with the gold-backed US dollar as the world’s reserve currency.

The Bretton Woods System worked well for several decades. By 1971, however, the US government had begun running huge deficits to fund the Great Society and the Vietnam War. Meanwhile, Germany and Japan had rebuilt into manufacturing powers that ended American industrial dominance. These factors led to the US dollar declining in value. Countries began redeeming their dollars for gold, which resulted in an unsustainable decline in our gold supply. To preserve our gold holdings, Richard Nixon took us off the gold standard on August 15th, 1971.

Of course, this immediately caused a further loss of confidence in the US dollar. Countries that had previously held the dollar as a reserve currency began to abandon it, causing its value to drop even more. American consumers felt this as an increase in the cost of imports. In addition, since the dollar no longer tied to gold, the US government could, and did, print even more dollars, which increased the currency supply even as demand for dollars declined. America began to experience widespread inflation.

Then the situation got worse. In a brief span of years, Libya, Algeria, Iraq, Nigeria, Venezuela, and Saudi Arabia all nationalized the assets of the Western oil companies operating in their countries. This gave OPEC (the Organization of the Petroleum Exporting Countries) almost total control over global oil production. The OPEC members had long felt that oil prices were kept lower than they ought to be to the West’s benefit and their detriment. In 1973, OPEC members unilaterally raised oil prices.

The effect of rising energy prices on an economy is quite complex but, to a first approximation, the result is that prices rise on all other goods and services while economic growth stagnates. The US economy was terribly battered - its currency had been devalued just when oil had gotten expensive! This was the cause of the dreaded stagflation that began in 1973 and lasted until 1983. .

And then the situation got… worser. The emboldened nations of the Middle East decided to renew their ongoing war with Israel. The Yom Kippur War of 1973 began with a two-front assault, with Syria attacking the Golan Heights and Egyptian attacking the Suez Canal. The USSR had supplied the Arab armies with anti-tank guided missiles and air defense missile systems. These new weapons, deployed for the first time, dealt exceptionally heavy losses to Israel’s forces. The Arab’s initial onslaught was so overwhelming that Israeli Prime Minister Golda Meir authorized a nuclear alert, ordering 13 atomic bombs be readied for use by missiles and aircraft.

As it happened, the Yom Kippur War ended without atomic bombs being deployed. But everyone knew the Middle East had come close to nuclear annihilation.

This posed a problem for, well, everybody. The entirety of industrial civilization depended on the ongoing flow of oil from the Middle East to the rest of the world. Nobody wanted the world’s most precious resource consumed in a mushroom cloud. The Arab states were especially nervous about what the next war might do to their burgeoning position.

Henry Kissinger, at that time US Secretary of State, saw a way to solve the problem. Actually he found a way to solve three problems: the Arab-Israel problem, the oil problem, and the currency problem. He traveled to Saudi Arabia, the world’s largest oil exporter, and negotiated a deal with them to create the petrodollar system. The arrangement had two components:

The US would guarantee the security of the Saudi Arabian regime and agree to sell them the best arms and equipment our military-industrial complex could supply. In exchange, Saudi Arabia would use its position in OPEC to guarantee that all oil trade was denominated in US dollars.

The US would open its markets to foreign investment from OPEC members. In exchange, a substantial portion of surplus oil proceeds would be used to purchase US Treasury debt.

This deal formed the basis of the petrodollar system. The US dollar was now backed, not by its own gold, but by other country’s oil!

The Financial Effects of the Petrodollar System

The financial effects of the petrodollar system cascaded across the US and the globe, impacting life for every consumer and producer on the planet.

The immediate or first-order effect of the petrodollar system was to restore the US dollar’s hegemony. Since every country in the world outside of OPEC needed to purchase oil, and OPEC would only sell oil for US dollars, every country in the world needed US dollars. The dollar became king again.

The second-order effect of the petrodollar system was to flood the US with inexpensive imported goods. As mentioned earlier, when a business sells goods within a country, it is paid for those goods in the country’s currency; and the cost of goods in that currency is based on the value of the currency internationally. The primary way to get US dollars is to sell goods in the US, so everyone in the world suddenly wanted to send us their goods in exchange for our US dollars. And since those dollars were the only way to buy oil, the dollar was strong, meaning the imports were cheap. At the time, this seemed like a remarkably good thing for American consumers — we will send you cheap imports and you will send us pieces of paper you print for free. (Not even pieces of paper — digital zeros in a ledger!)

But it wasn’t actually a good thing. The third-order effect of the petrodollar system was to reduce the demand for exports from the United States. Remember, under the Bretton Woods system, trade with the US had basically worked like this:

Japan (or any other country) sold goods in the US in exchange for US dollars.

The US sold goods in Japan in exchange for Japanese yen.

Japan either redeemed their US dollars for gold from the US, or sold its dollars in exchange for yen. Which of these options its pursued depended on how much yen the US had to exchange, e.g. it depended on US exports to Japan.

Foreign exchange, imports, and exports thus formed a triangle that tended to balance out. (We’re ignoring investment at this time, as foreign investment into the US wasn’t a major factor for the US until after the petrodollar system went into place.) Under the petrodollar system, foreign countries no longer needed to redeem their US dollars for American goods or gold. Instead, they could use them to buy OPEC oil. And they did.

Put another way, before the petrodollar system, the US had to export goods to keep the dollar strong. But the petrodollar system made dollars the only currency capable of purchasing oil, which everyone needed. And so, after the petrodollar system, the US could just export dollars.

The fourth-order effect of the petrodollar system was to financialize and deindustrialize the American economy.

When a country can produce a particular good for export at a lower relative cost than other countries can produce it, that country is said to have a comparative advantage in that good. The petrodollar system gave the US comparative advantage in manufacturing dollars. It could manufacture them at zero cost! No one else could manufacture them at all.

Under conditions of free trade, a country will both produce and export more of the good for which they have a comparative advantage, but will produce less and import more of those goods for which they do not. And that’s exactly what happened in the United States. America produced more dollars and produced much less of everything else.

When I say “produced more dollars,” I mean that literally. When a commercial bank makes a loan, it creates new dollars out of thin air. It manufactures them on demand, like Printful.com but instead of t-shirts, banks make greenbacks. The finance industry was, by far, the biggest beneficiary of the petrodollar system. The manufacturing sector, along with its union workforce, was the biggest victim. The collapse of America’s manufacturing heartland into the wasteland we call the Rust Belt was directly caused and/or exacerbated by the petrodollar system.

So at this point, the US was exporting dollars and importing goods; and Europe and Asia were exporting goods and importing dollars, then spending the dollars to import oil from OPEC members. What were the OPEC members doing with their dollars? Well, some of those big bucks were spent buying M1 Abrams tanks and other expensive products of the US military-industrial complex. (That’s the reason the US can still manufactures guns, missiles, and tanks even though it can’t manufacture diapers or telephones.)

But even the most paranoid sheik only needs a few thousand tanks and fighter jets. The rest of OPEC’s dollars were invested in the United States in a process known as petrodollar recycling. Within 5 years, over $450 billion had been recycled, with 90% of that made by the Arab countries of the Persian Gulf along with Libya. What did they invest in? US government debt. US stocks. US real estate. In short: assets.

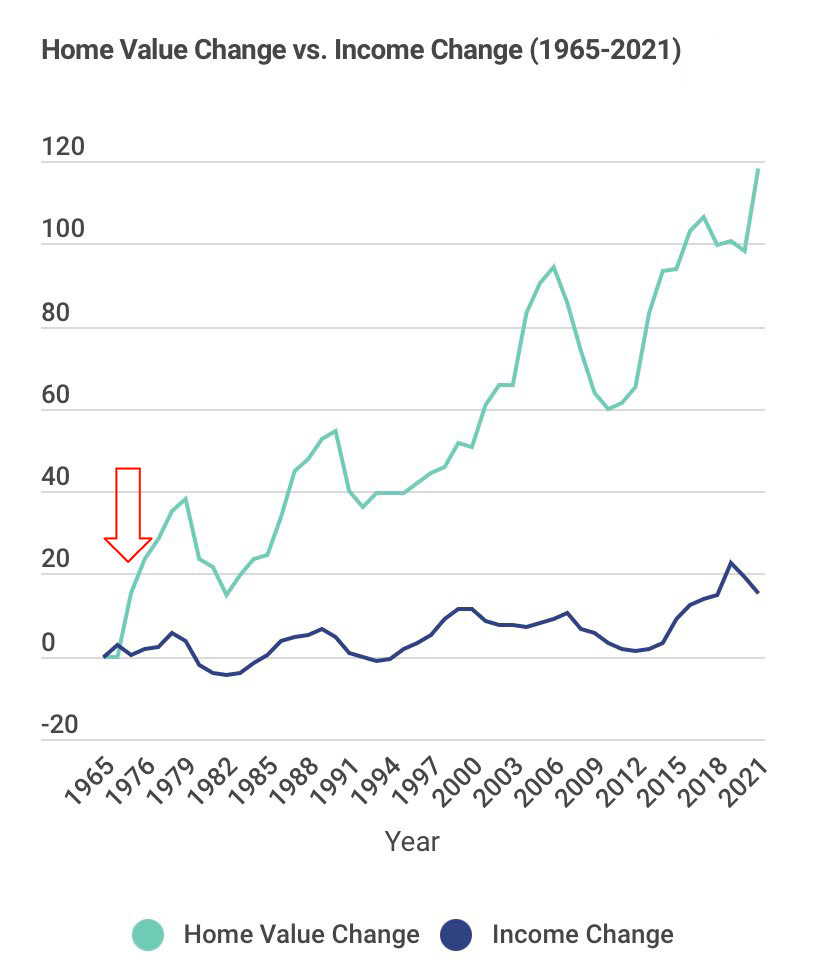

Thus the fifth-order effect of the petrodollar system was to create a sustained increase in the price of American bonds, stocks, and real estate. The petrodollar created asset inflation. Banks benefited, as did existing homeowners and investors. The working class felt asset inflation in the form of rising rents.

Viewed as a whole, then, the petrodollar system was incredibly beneficial for (a) commercial banks, (b) arms manufacturers, (c) real estate owners, and (d) stockholders.

For everyone else, the petrodollar system turned out to be a Trojan Horse, a promising gift that destroyed the recipient. By ending the oil crisis and reducing the price of imports, the petrodollar initially seemed to benefit consumers. But in order to consume, consumers needed to have money, and to have money they needed well-paid jobs. By deindustrializing the US, the petrodollar system destroyed the manufacturing jobs that had sustained the working class. In order to maintain their standard of living, US consumers began to borrow money. As their debt rose, though, their position only worsened.

In short, the petrodollar system is directly responsible for almost all of the financial problems that plague the American economy. This is a radical claim, to be sure. To help buttress my theoretical argument, I’m going to close out this essay with some empirical data drawn from a wonderful website called WTF Happened in 1971?.

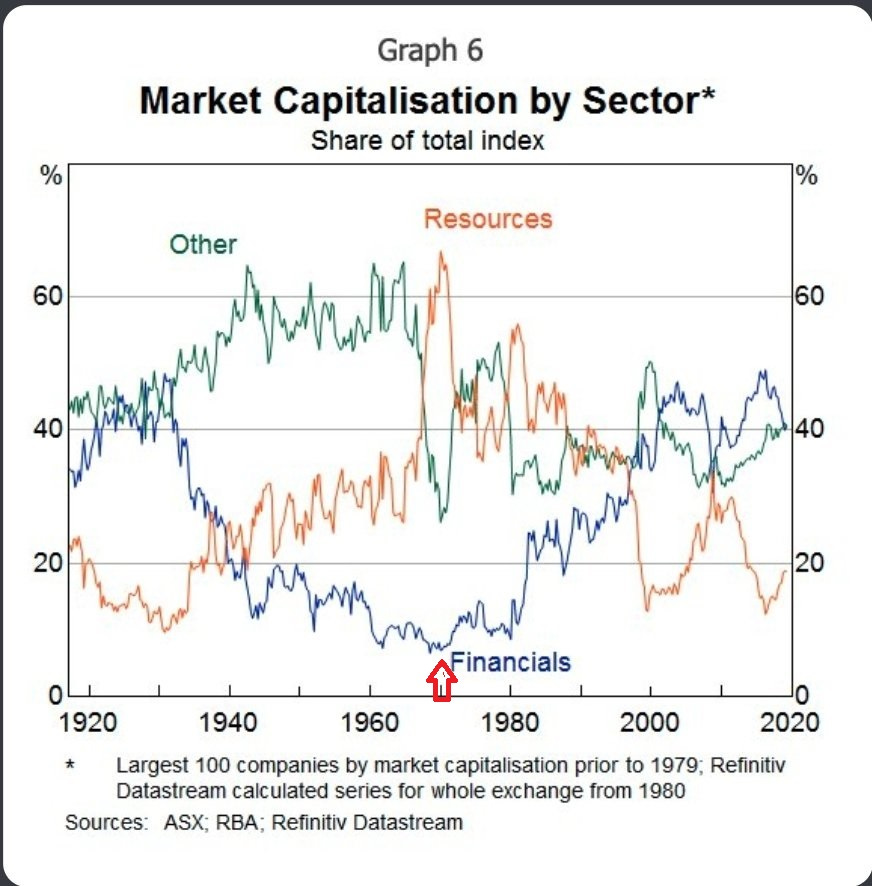

Deindustrialization and Financialization: Prior to the petrodollar system our economy was dominated by manufacturing. Now our economy its dominated by finance.

Transformation from Exporter of Goods to Importer of Goods: Prior to the petrodollar system, we were a net exporter of goods. Now we are a net importer of goods. We export dollars, we import cars and phones.

Wage Decline with Asset Inflation: Prior to the petrodollar system, our wages grew in conjunction with the economy. Under the petrodollar system, wages stagnate while the economy (measured in the value of stocks and real estate) grows. Big banks and big business benefit, while workers lose.

That’s just a few of the many, many charts found at WTF Happened in 1971? If you feel the need for further contemplation on the Tree of Woe, head over there see more data proving how bad things have gotten under our petrodollar regime.

In the next installment of Running on Empty, I’ll explain the political implications of the petrodollar system, revealing how the need to enforce US dollar hegemony over oil transactions has driven the US into an endless series of wars, at terrible cost to our soldiers and workers.

The Petrodollar financialized the Murican economy and has now made it vulnerable to a D-Day style Rout and Delenda est, Third Punic War style.

Carthage sacrificed its offspring, used mercenaries en masse, engaged in cannibalism (and all other forms of barbarism), etc, etc. How ironic that the "New Carthage" of our day and age beckons ever closer to the fate suffered (rightfully so) by its predecessor?

As the esteemed Andrei Martyanov notes: The US military has never fought (not even in WW II) under situations where the underlying skeletal C4ISR was *directly* attacked at that depth. As such its military history (compared to Civilization-states like Russia) is paltry at best.

Defeat is inevitable. For many, the rational course of action (assuming high mobility, low social obligations and enough capital) is to escape the US; before the barbarism inevitably starts.

Once the Nuclear threshold is crossed (the nuclear death threshold is about 800 million at the low end to 2 billion at the high end); Basic Human Disgusts (such as Cannibalism, Necrophilia and other more vile things for which words have not even been invented) are Fair play.