Gross Domestic Product or GDP is an alleged measure of the economic performance of a country that supposedly represents the total monetary value of all finished goods and services produced within a country's borders in a specific time period, typically calculated on an annual or quarterly basis. GDP is widely — and wrongly — used as an indicator of a country's economic health and a gauge of its standard of living.

Five types of GDP are commonly referenced.

Nominal GDP: This is the total value of all goods and services produced in an economy, measured in current prices, without adjusting for inflation.

Real GDP: This measures the value of all goods and services produced in an economy, adjusted for inflation. Real GDP supposedly provides a more accurate reflection of an economy's size and how it's growing over time.

GDP Per Capita: This is the GDP divided by the population of the country. It allegedly gives an average economic output per person and is often used as an indicator of the standard of living. GDP Per Capita can be Real or Nominal.

PPP-Adjusted GDP: Purchasing Power Parity (PPP)-adjusted GDP is a measure of a country's gross domestic product (GDP) that has been adjusted to account for differences in the cost of living and price levels between countries. PPP-Adjusted GDP can also be Real or Nominal.

PPP-Adjusted GDP per Capita: This is GDP Per Capita adjusted for Purchasing Power Parity. This, too, can be Real or Nominal.

Whatever type of GDP is being used, the most common method used to calculate GDP is called the expenditure method. It sums up all expenditures made in the economy over a certain period. The formula for GDP using the expenditure approach is:

GDP=C+I+G+(X−M)

where:

C = Consumption: Total spending by households on goods and services.

I = Investment: Spending on business investments in equipment and structures, residential construction, and changes in business inventories.

G = Government Spending: Total government expenditures on goods and services.

X = Exports: Value of goods and services produced domestically and sold abroad.

M = Imports: Value of goods and services produced abroad and purchased domestically. (X - M) represents net exports.

Note that economic transfer, e.g., re-distribution of income, is not counted in GDP. This is true of both public and private transfers. Thus, when the government sends you a $2,000 social security check, this payment is not included in G (Government Spending). When you spend this $2000 on goods and service, it is included in the GDP under C (Consumption). Likewise, if you give your best friend $2,000 in cash for his birthday, this is not counted as C (Consumption) by you. Only when your friend spends the $2000 on goods and service is it then included.

Economic transfers must be excluded from GDP or the entire calculation becomes a farce of double- and triple-counting. Imagine if you could increase the GDP just by handing cash back and forth between you and your friend! That would be ridiculous. Wait for it…

Why GDP Matters

Governments and central banks use GDP data to formulate fiscal and monetary policies. For instance, during periods of low GDP growth or recession, governments might implement stimulus measures to boost the economy. Likewise, investors use GDP data to inform decisions about where to invest. A growing GDP is often seen as a sign of a healthy economy.

Neoliberal economists like to trumpet GDP growth as evidence that their policies work. The table below, from the Maddison Project Database 2020 and presented by Our World in Data, shows Real PPP-Adjusted GDP per Capital from 1820 to 2018.

Economists and pundits also use GDP to make comparisons between the economic performance of different countries, believing that from this data they can understand relative economic strengths and weaknesses.

For instance, at the outbreak of the Russo-Ukraine War, pundits were wont to declare that “Russia has a GDP smaller than Texas” in order to explain why the war effort would be impossible for their tiny economy to sustain.

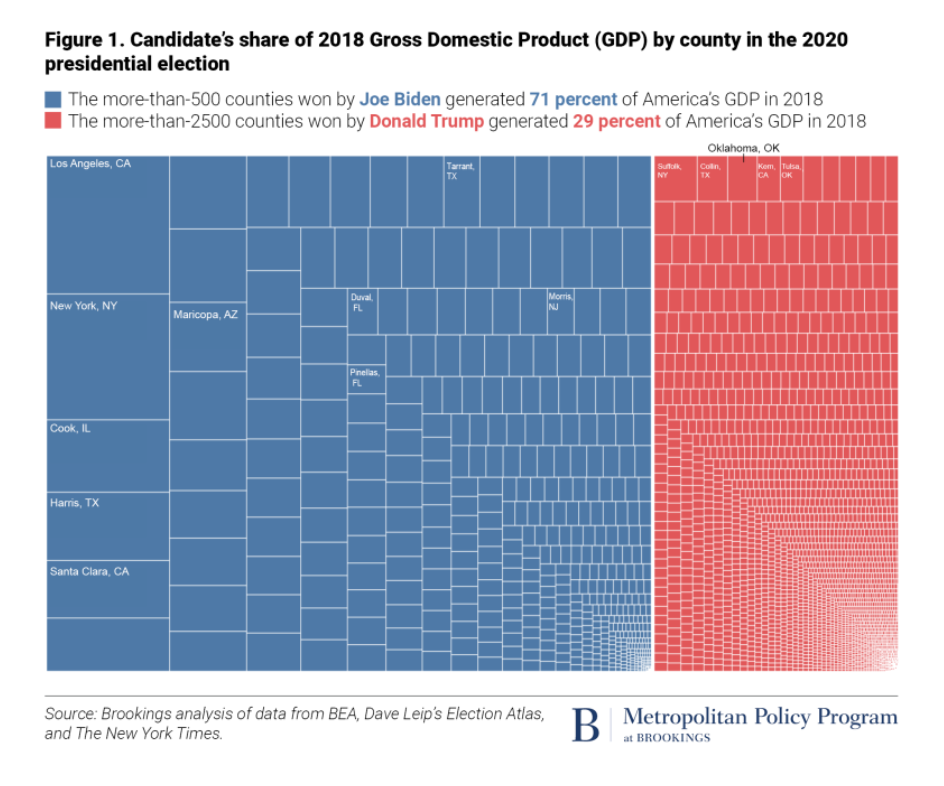

GDP is even used to make comparisons between different states in the US, usually to advance the progressive agenda. The Brookings Institute, for instance, uses GDP to claim that “Biden-voting counties equal 70% of America’s economy.”

But do they? Are the Blue Counties really responsible for 70% of the country’s productivity? Is Russia’s GDP really just a fraction of the US GDP? Does GDP actually measure what it purports to measure?

Gross Domestic Fraud #1: Rent and Imputed Rent

When households pay rent to landlords for the use of housing, this expenditure is considered a purchase of housing services. These rent payments are included in the consumption component (C) of GDP because they allegedly represent the value of the housing services consumed by renters.

To ensure consistency and comparability, GDP also includes imputed rent for owner-occupied housing. Imputed rent is an economic concept used to estimate the value of housing services that homeowners receive from living in their own homes. It represents the rent that homeowners would have to pay if they were renting their own homes, rather than owning them.

E.g. suppose that a homeowner has a home valued at $400,000. Suppose, further, that the average monthly rent for a house similar to the one owned by a homeowner is $2,000. The imputed rent for the homeowner would be $2,000 per month, which amounts to $24,000 per year. Therefore, $24,000 is added to GDP as part of household consumption expenditure on housing services.

Mainstream economists, of course, argue that housing services, whether rented or owner-occupied, provide significant utility and value to individuals and that including rent and imputed rent in GDP captures this value, reflecting the consumption of housing services.

But if GDP is intended to represent the production of an economy, including the full value of rent and imputed rent is a gross fraud. As Henry George demonstrated, land is fundamentally different from capital and labor, because it is not produced by human effort and its supply is fixed. Therefore, the portion of rent derived from land (i.e., the value of land itself) represents unearned income. It arises not from any productive activity but from the inherent value of the location and the community around it.

Rent paid for land is simply an economic transfer, not a reflection of productive economic activity. It transfers wealth from tenants to landowners without creating new goods or services. It should not be treated as a good or service “produced” by an economy.

If the theoretical Georgist argument isn’t enough to convince you, here are some empirical examples of how including land rent into GDP is misleading.

Population Density becomes an Economic Good: All else being equal, high population density creates more competition for land, which drives up land price. Imagine that new environmental regulations mandate that certain areas of the countryside be vacated to preserve nature, with the residents of those areas being relocated into cities. The migration into the cities would increase the land value of the cities, driving up rent and home prices in the cities, increasing GDP. But nothing has improved for the citizens - they are worse off!

Empty Foreign-Owned Homes Raise GDP: Imagine that, due to petrodollar recycling, foreigners come into possession of large sums of US dollars. They re-invest these dollars by investing in US real estate, purchasing vacation properties across the Atlantic and Pacific coasts. The purchase of these properties is merely an economic transfer from one owner to the other. However, these vacation homes sit empty for 10 months out of the year. By removing these homes from the market, they increase the scarcity of coastal properties for people who actually need or want to live by the coast, driving up the land value of those regions, and thus increasing the rent and imputed rent. GDP calculations include the rent and imputed rent into their calculus, and indicate that both GDP and per-capita standards of living have greatly improved! But of course there has not been any improvement at all - in fact, the residents are worse off.

To what extent does the inclusion of land rent skew the GDP calculation? Hugely. Rent and imputed rent account for approximately 12% of the GDP. And across the entire United States, land rent constitutes approximately 50% of the rent. The inclusion of land value thus falsely raises the GDP by 6%!

But this understates the pernicious effects, because land value is much higher in cities than anywhere else. In a city like New York or San Francisco, land value constitutes 60-70% of the total property value. Thus, if the rent for a property is $3,000 per month, approximately $1,800 to $2,100 could be attributed to land value!

Conversely, in suburban regions across most of the U.S., land value accounts for approximately 30-40% of the property value. For a property with $2,000 monthly rent, around $600 to $800 might be the land value component. And in rural settings, where land is less scarce and less valuable, land only makes up 10-20% of the property value. For a property with $1,000 monthly rent, $100 to $200 could be attributed to land value.

The inclusion of land rent into GDP thus has three pernicious effects:

It falsely inflates US GDP by at least 6%.

It creates the false impression that urban areas are more productive than suburban and rural areas because they offer so much better “housing services.”

It creates the false impression that a region with high land value is highly productive, when actually it might be suffering from poorly regulated housing markets, bad zoning, foreign ownership, and more.

Gross Domestic Fraud #2: Homemaking

Mainstream economists argue that they must impute the value of rent to home owners in order to maintain consistency and comparability with the value of rent for renters. However, these same economists are entirely unwilling to impute the value of daycare, education, and domestic services provided by homemakers to their households. Yet these same expenses are included if provided by professionals outside the home.

Consider two households.

Bill and Amy Goddard are a married couple with two children. Bill works as a firefighter, earning $80,000 per year. Amy is a stay-at-home mother who cares for her home and her two children.

Cameron Draper and Karen Whitfield-Draper are a married couple with two children. Cameron works as an accountant, earning $80,000 per year. Karen works as a human resources manager, earning $40,000 per year. Cameron and Karen are too busy with her career to manage the home or raise the children. They spend $40,000 per year on childcare services.

The $40,000 that the Whitfield-Drapers spend on childcare services is included in GDP. Meanwhile, Amy Goddard’s childcare is not included in GDP at all. Therefore, the Goddards contribute just $80,000 to GDP, while the Whitfield-Drapers contribute $120,000!

But that makes no sense whatsoever. Having childcare provided by a mother, rather than a childcare service, is demonstrably better on average for children than having the childcare provided by a daycare service. Amy Goddard isn’t just providing an economic service, she’s providing a better service than what Karen Whitfield-Draper is getting when she pays for it. But GDP says otherwise!

It gets worse. Imagine that Karen Whitfield-Draper is persuaded by Amy Goddard that her children would benefit from her personal love and care. She quits her job and becomes a stay-at-home mother. This removes $40,000 from the GDP, as each household is now only contributing $80,000 to GDP. The state government is aghast - GDP has dropped by 50% in the Whitfield-Draper household!

Therefore, the wise and progressive leadership of their state passes a law that makes it illegal to provide childcare services in your home. (If that seems absurd, consider that homeschooling your children was illegal for many years in the US, and remains illegal in most of Europe.) Because of this new law, Amy and Karen must seek employment.

Amy takes a job working as a nanny to the Whitfield-Draper household, a position for which she receives $40,000 per year. Meanwhile, Karen takes a job working as a nanny to the Goddard household, a position for which she receives $40,000 per year. The GDP contribution from these households explodes to $120,000 per year each!

But all that’s happened is that Amy is raising Cameron’s kids, and Karen is raising Amy’s. Is anyone better off? Not at all, certainly not the children. It’s nothing but an economic transfer between two households.

There are two solutions to this problem. One would be to exclude the cost of children’s care and education from GDP. The other would be to include the imputed value of children’s care and education by homemaker to GDP. Don’t expect either to be taken.

Approximately 60% of US households have their children in daycare, but the number drops to 40% for households earning over $150,000 per year. That fact alone should silence critics who suggest that professional daycare is “better”. The richer the household, the more likely it is have a stay-at-home homemaker. Unless rich people have suddenly decided to cripple their children with inferior care, stay-at-home childcare must be superior. Since the value of stay-at-home care is excluded from GDP, this actually reduces the apparent disparity in per-capita GDP between the wealthiest households and the rest of us!

Moreover, because the current system gives the false impression that double-income households are more productive than traditional single-income households that self-sufficiently provide the services themselves, it makes Blue urban cities seem much more productive than Red suburban and rural areas. That, too, is quite convenient for our progressive elite.

The same discrepancy is seen in homeschooling. (Are you noticing a pattern?) The value of the educational services provided by homeschooling is excluded from GDP, while the value of educational services provided by state or private schools is not. Overall, about 6% of American children are homeschooled by their parents. But in rural or Red states such as Alaska, Idaho, or Tennessee, up to 13% of children are homeschooled. Conversely, in urban Blue states such as Massachusetts or New York, only about 3% of children are homeschooled.

As homeschooling becomes more popular, the GDP declines and the region becomes officially “poorer” because of its lower per-capita GDP. Since expenditure on primary education accounts for approximately 5% of the US GDP, this is a large effect.

Moreover, the implications of this gross domestic fraud are international. Progressive organizations such as the United Nations like to emphasize how, by making it possible for women to enter the workforce, they are helping lift the world out of poverty - and they have the GDP statistics to back it up.

But since they were never adding the value of the domestic services those women were providing in the first place, at least part of the alleged increase in GDP is just as illusory as the increase in GDP when Amy Goddard had to stop being a homemaker. Again we see that traditional ways of life in the country are accounted for in ways that make them seem worse for standard of living.

Gross Domestic Fraud #3: Financial Services

In 1947, the Agriculture, Energy, and Manufacturing sectors of the American economy accounted for approximately 43% of the US GDP, while the Finance, Insurance, and Real Estate (FIRE) sector accounted for 10%. In 2024, the Agriculture, Energy, and Manufacturing sectors accounted for approximately 22% of the US GDP, while the FIRE sector accounts for 21%. America once produced energy, food, and goods worth four times as much as the financial services associated with that production. Today, the sectors are virtually equal in size. The 100% growth in the relative size of the FIRE sector has thus disguised the 75% decrease in the relative size of the “hard” sectors of the economy.

But should FIRE be included in GDP at all? Mainstream economists think so. They assert that financial institutions like banks, investment firms, and credit unions facilitate the allocation of capital; that financial products such as derivatives help manage and mitigate risk (stop laughing, 2008 survivors); and that insurance companies contribute to capital formation and decrease risk.

Therefore, the interest charges, brokerage fees, advisory fees, underwriting fees, and service charges on financial and insurance accounts are added to GDP. But this is ridiculous! To understand why, let's consider some thought models.

First, let’s look at brokerage services in two economies. In the first economy, financial services are provided by a legally licensed cartel of brokers who charge a commission of 1% of transaction value on the stock and commodity exchanges they manage. For every $100 bought or sold on the exchange, the brokers collect $1.

In the second economy, financial services are provided by an online brokerage platform that charges a commission of 0.1% on the transaction value of the stock and commodity exchanges they manage. For every $100 bought or sold on the exchange, the platform collects $0.10.

Let’s assume that there are $1 trillion in transactions in both economies. In the first economy, the brokers collect $10 billion in fees. In the second economy, the brokerage platform collects $1 billion in fees for providing the exact same services. But the only difference is that the broker cartel was able to extract a lot more money for doing the same thing. This is an economic transfer, not a productive activity.

Now let’s look at insurance services in the same economy but under two different circumstances. Let’s say that in August 2024, residents of Memphis, Tennessee pay $200 million per year to GEICO to insure their homes. Then, in September 2024, seismologists working for the Federal Emergency Management Authority detect that the New Madrid Seismic Zone (NMSZ) has become active, putting Memphis at grave risk of earthquake. Instantly, GEICO raises the premiums on home insurance in Memphis, Tennessee from $200 million annually to $500 million annually to account for the increased risk. Homeowners in Memphis are thus transferring another $300 million to GEICO. This increases the GDP of Memphis, TN by $300 million.

Do the residents of Memphis dance in the streets at this massive increase in GDP? Has the economy of Memphis actually become more productive? The residents aren’t dancing, they’re crying — not only are they now at risk of an earthquake, they’re being impoverished by the insurance premiums they have to pay for that new risk! The economy of Memphis has not become more productive; rather, resources are just being redistributed. This is, again, an economic transfer being counted as a productive activity.

What about interest charges? Let’s imagine that in August 2024, the interest rate on 30-year fixed mortgages is 7.5%. However, in September 2024, the US Space Force detects an asteroid en route to Earth that has a high percentage chance of striking the continental United States in 10 years. The impact will have a devastating effect on property values and job prospects, making it much more likely that mortgages taken out will end in foreclosure or write-off. The banking industry therefore raises the interest rate on 30-year fixed mortgages to 15%. This doubles the GDP contribution from new mortgages! But, again — is anyone better off? Is the US economy more productive? No and no! All that’s happened is that money has been redistributed from one party to another.

And, just as with housing expense and childcare expense, the GDP calculations applied to the FIRE sector are structured to make Blue urban areas seem disproportionately productive relative to Red and rural areas. All of the interest charges, brokerage fees, advisory fees, underwriting fees, and service charges vacuum wealth from productive households and transfer them into banks and insurance companies located in urban metropoles like New York City.

The Gross Domestic Fraud Ultimately Just Defrauds America

Benjamin Disraeli is reputed to have remarked “There are three kinds of lies: lies, damned lies, and statistics.” By Disraeli’s standards, GDP, as calculated today, is all three kinds of lie.

Were GDP simply a technical measurement that was cautiously deployed by economic experts in academic papers, its miscalculation and misuse would be irritating, but not catastrophic. Unfortunately, GDP has become the central measure by which policymakers gauge economic strength and prosperity. That has led to terrible policy errors.

For the last 50 years, we have deindustrialized our economy, thereby destroying its actual productivity, all while fooling ourselves into believing that our economy is becoming more productive because the sum of our economic transfers on non-productive land rent or interest charges are going up.

We have persuaded ourselves that replacing the single-income household with a stay-at-home caregiver with a double-income household creates a great increase in prosperity; that homeschooling our children harms economic growth; that being charged high interest rates represents receiving a valuable service; and that asset inflation in home prices due to foreign ownership is making us a more productive nation.

And, since the beginning of the Russo-Ukraine War, we have overestimated the strength of American sanctions and underestimated the productive capacity of the Russian economy, because our leaders mis-used GDP to assess the warfighting power of our nation and our adversary.

When President Joe Biden said, “Russia's economy is less than one-twentieth the size of the U.S. economy. It’s smaller than that of Italy, France, or the United Kingdom,” he was relying on GDP.

When Senator Lindsey Graham said, “Russia is a gas station masquerading as a country. Its economy is smaller than that of Texas,” he was relying on GDP.

Were they lying? A liar knows he is misrepresenting the truth, a bullshitter often believes his own bullshit. President Biden and Senator Graham weren’t lying when they made these claims; they were believing what GDP told them. But GDP is bullshit.

Contemplate this on the Tree of Woe.

P.S. Further Reading

Once you are done contemplating today’s article on the Tree of Woe, you might like to learn more about the flawed manner in which GDP is calculated. I highly recommend the book The Value of Everything by Mariana Mazzucato. It’s the rare case where the publisher’s description of the book actually undersells how good the book really is:

The Value of Everything rigorously scrutinizes the way in which economic value has been accounted and reveals how economic theory has failed to clearly delineate the difference between value creation and value extraction. Mariana Mazzucato argues that the increasingly blurry distinction between the two categories has allowed certain actors in the economy to portray themselves as value creators, while in reality they are just moving around existing value or, even worse, destroying it.

I've been grumbling for years about how GDP doesn't include home labor for self. It's not just childcare, it's food, cleaning, entertaining at home, etc.

But the rent aspect is new to me. I feel a twinge of enlightenment.

And then the financial aspect! More reporting things to the government means more consumption! If economic growth is entirely recording things better in order to obey the IRS and assorted regulators, we are supposed to be better off. Make that two twinges of enlightenment.

Question: if I go to the doctor and the insurance company pays for it instead of me, does that still count as consumption?

The GDF (i.e. Gross Domestic Fraud ) is a Mammoth Case of 'Play Stupid Games, Win Stupid Prizes!' a la how Rampant & Definitive the Damage to the Real, Physical Economy has been these past few decades or so. As America's Final War approaches, Economists will continue to lead the American people off a cliff and into the Maw of the DOOM-ed Nuclear Hellscape. If there are Future polities on the Desolated CONUS, they will have Capital Punishment Laws (de Jure & de Facto) against practising any & all "Economics"... now formally dubbed 'Magical Thinking & Numerology.'