1. America Faces a Debt Crisis

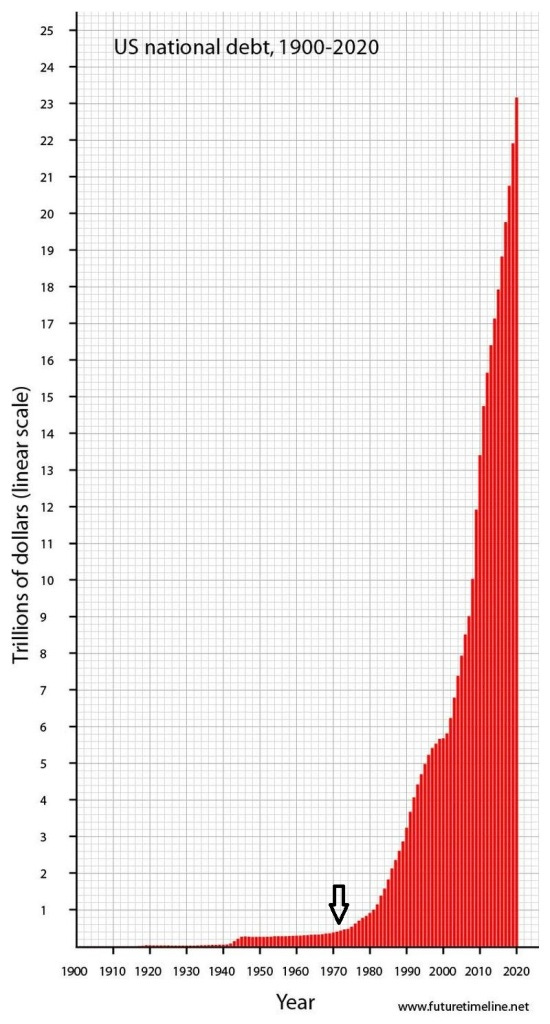

The United States stands at the precipice of fiscal ruin. With the national debt now exceeding $36 trillion, our debt-to-GDP ratio has surged past 120%, a level historically associated with economic collapse. We are in uncharted waters, navigating a storm that has capsized empires and ruined nations. To put it bluntly: we are broke, but we refuse to admit it.

In history’s ledger, nations that allowed their debts to spiral beyond control have suffered dire consequences. Weimar Germany printed its way to hyperinflation and political collapse. Greece, at 170% debt-to-GDP, was stripped of sovereignty, forced to endure austerity dictated by foreign creditors. Argentina, defaulting again and again, became a case study in perpetual financial disaster. The United States, though still buoyed by global reserve currency status, is accelerating toward the same fate—unless radical action is taken.

The Cost of Debt: A Government Eating Itself Alive

A nation that cannot control its spending is a nation that will be ruled by its creditors. In fiscal year 2025, interest payments on the U.S. debt will exceed $950 billion—more than the entire defense budget. Let that sink in. The United States now spends more servicing old debts than defending itself.

How does the federal budget break down?

Social Security: 23% of spending

Healthcare (Medicare & Medicaid): 25% of spending

Defense: 15% of spending

Interest Payments: 17% and rising

This means the government is spending more on debt interest than on national security and is rapidly approaching the level spent on healthcare. And it gets worse. Interest payments are projected to exceed $1 trillion per year by 2026 as interest rates rise. The more we borrow, the more we pay—feeding a cycle of ever-growing debt, forcing future generations into servitude to sustain a broken system.

Now, for years, the government kept the debt under control with artificially low interest rates. That era is over. As rates rise, every dollar borrowed in the past becomes an exponentially growing liability. The Congressional Budget Office estimates that, by the early 2030s, interest will consume nearly half of all federal tax revenues.

At that point, the choice will be stark: default, inflate, or destroy the economy with confiscatory taxes. The political class will pretend there’s a way to avoid this reckoning. There isn’t. The only question left is whether America will take radical action before the crisis erupts—or after the economy collapses under its own weight.

This is not a drill. The abyss is ahead! The time to act is now.

The Tree of Woe has a plan.

2. How Did We Get Here?

To understand the perilous fiscal path the United States now treads, we must journey back to the nation's inception, where the seeds of our current debt crisis were first sown. Here, then, is the history of the debt.

In the aftermath of the Revolutionary War, the fledgling United States found itself burdened with substantial debt. Enter Alexander Hamilton, the nation's first Secretary of the Treasury, who perceived this financial obligation not as a curse, but as a unifying force. He famously asserted, "A national debt, if it is not excessive, will be to us a national blessing." Hamilton's strategy was multifaceted:

Assumption of State Debts: He proposed that the federal government assume the war debts of individual states, thereby centralizing financial obligations and strengthening the union.

Establishment of a National Bank: Hamilton advocated for a national bank to manage the country's finances and issue a stable national currency.

Creation of a Tax System: To service the debt, he introduced taxes, including controversial excise taxes, to ensure a steady revenue stream.

This approach aimed to establish creditworthiness, encourage economic development, and bind the states together under a strong central government. It worked, mostly (there was a small hiccup from 1861-1865). For much of the 19th and early 20th centuries, the national debt remained relatively modest, with fluctuations primarily due to wars and economic downturns.

However, the onset of the Great Depression in 1929 marked a turning point. In response to the economic catastrophe, President Franklin D. Roosevelt implemented the New Deal, a series of programs and public works projects designed to revive the economy. These initiatives required substantial government spending, leading to a significant increase in national debt.

The situation was further exacerbated by World War II, which necessitated unprecedented military expenditures. Between 1940 and 1945, the national debt skyrocketed from approximately $51 billion to $260 billion, marking a more than fivefold increase.

Following World War II, the United States experienced robust economic growth, which facilitated a reduction in the debt-to-GDP ratio. Despite absolute debt levels remaining high, the booming economy meant that the relative burden of debt decreased.

This trend continued until the 1980s when President Ronald Reagan ushered in a new era of fiscal policy. His administration implemented substantial tax cuts coupled with increased defense spending to counter the Soviet Union during the Cold War. Consequently, the national debt more than tripled during Reagan's tenure, rising from $908 billion in 1980 to approximately $2.6 trillion by 1988.

The 1990s brought a momentary reprieve. Under President Bill Clinton, a combination of tax increases, spending restraints, and a booming economy led to budget surpluses. By 2000, the national debt had decreased to less than 33% of GDP, and there was optimism that the debt might be eliminated entirely.

However, the early 21st century dashed these hopes. A series of events contributed to a renewed surge in national debt:

Tax Cuts: The early 2000s saw significant tax reductions, which decreased federal revenue.

Wars in Afghanistan and Iraq: Prolonged military engagements led to substantial defense spending.

Great Recession: The 2008 financial crisis prompted massive government interventions to stabilize the economy.

These factors propelled the national debt from approximately $5.6 trillion in 2000 to over $10 trillion by 2008.

And then things got worse. In the past decade, the national debt has ballooned at an alarming rate. Several key factors have driven this surge:

COVID-19 Pandemic: The government's response to the pandemic involved trillions in stimulus spending to support individuals and businesses.

Tax Policy: Continued tax cuts without corresponding spending reductions have exacerbated deficits.

Entitlement Programs: Rising costs for Social Security, Medicare, and Medicaid have added to the fiscal burden.1

And that’s how we arrived where we are today, with the national debt standing at the aforementioned $36 trillion, the debt-to-GDP ratio exceeding 120%, and the cost of debt service exceeding 17% of federal revenue.

The past decade's debt accumulation is literally unprecedented in American history and is virtually unprecedented in world history. That begs us to ask…

3. What Makes It Possible?

The United States has managed to amass an astronomical debt without immediate economic collapse, a feat made possible by two intertwined mechanisms: the Federal Reserve's monetary policies and the petrodollar system. These pillars have not only sustained our borrowing spree but have also masked the true extent of the fiscal rot beneath.

Established in 1913, the Federal Reserve (the Fed) was designed to stabilize the financial system. Over time, it has morphed into an enabler of perpetual debt. By manipulating interest rates and engaging in quantitative easing, the Fed has created an environment where borrowing is cheap, and fiscal discipline is anachronistic.

When the government spends beyond its means, the Treasury issues bonds to cover the deficit. The Fed purchases these bonds, injecting freshly created money into the economy. This process, known as monetizing the debt, expands the money supply without a corresponding increase in goods and services, laying the groundwork for inflation.

However, the anticipated rampant inflation has often been subdued. How? If you’re a long-time reader, you know I’ve already given you the answer in detail. In the 1970s, a tacit agreement with oil-producing nations ensured that oil transactions would only be conducted in U.S. dollars—the birth of the petrodollar. This arrangement created a constant global demand for dollars, as countries needed them to purchase oil.

This demand allowed the U.S. to export inflation. As the Fed increased the money supply, excess dollars flowed abroad to facilitate international trade, particularly in oil. Foreign nations held these dollars in reserves or invested them back into U.S. assets, such as Treasury bonds, effectively recycling them.

Domestically, the surge of dollars inflated asset prices—stocks, real estate—creating an illusion of prosperity even as the underlying debt burden grows. Meanwhile, the true inflationary pressures were dispersed across the globe, diluting their immediate impact on the U.S. economy.

Through the Fed's monetary alchemy and the petrodollar system, the U.S. was able to sustain an untenable fiscal path, deferring the consequences of excessive debt. But this is a mirage. The continuous expansion of the money supply and reliance on foreign demand for dollars are not sustainable strategies. As global dynamics shift and the petrodollar's dominance wanes, the deferred inflation and debt burdens threaten to converge, precipitating a crisis that can no longer be postponed.

The mechanisms that have allowed America to live beyond its means are eroding. The reckoning approaches.

4. Will DOGE Save Us?

While I would never call our government a bastion of long-term system thinkers, not everyone in D.C. is utterly oblivious to the looming crisis.

Elon Musk, for one, has been loudly expressing alarm over the nation's escalating debt. He has repeatedly warned that without immediate action, the U.S. faces potential bankruptcy and a devaluation of the dollar, and has called for urgent reform.

In response, God-Emperor Donald Trump has appointed Musk to lead the Department of Government Efficiency, with a mandate to identify and eliminate wasteful government expenditures. According to the Washington Post, DOGE plans to cut $2 trillion in government spending. The initiative has already claimed over $1 billion per day in spending cuts, though detailed breakdowns remain scarce.

Unfortunately, Musk's approach has sparked what the mainstream media calls “legal and ethical concerns” and the Tree of Woe calls “a disgusting last-ditch defense of the deep state by the parasites who suck on it.” Given Trump’s leadership and the likely support he will receive from the Republican Congress and the conservative-leaning Supreme Court (which has already paved the way for a reduction in the administrative state with a series of important decisions) I’m hopeful that Musk will be able to achieve the hoped-for $2 trillion.

But it won’t matter.

While DOGE's efforts to trim government fat are commendable, they barely scratch the surface of the nation's fiscal woes. The projected savings, even in the most optimistic scenarios, fall short of addressing the structural imbalances driving the debt. It's akin to bailing water from a sinking ship with a teaspoon. The real culprits—entitlement spending, defense budgets, and interest obligations—remain largely unaddressed.

While the Department of Government Efficiency represents a proactive attempt to tackle government waste, it is not the panacea for America's debt crisis. The scale of the problem demands comprehensive fiscal reforms that address the root causes of the debt. Without such fundamental changes, DOGE's efforts, however well-intentioned, will remain insufficient—a band-aid on a hemorrhaging wound.

5. What Can Be Done?

A reckoning is coming. The old ways—raising taxes, slashing spending, pretending that economic growth will somehow outpace the exponential growth of debt—are all exhausted. The debt has grown beyond the realm of conventional solutions. No mere policy adjustment can fix it. No budget deal, no spending freeze, no tax hike can halt what is coming. The only way forward is a total restructuring of the financial system itself.

Fortunately, such a solution already exists. It was formulated by some of the brightest economic minds of the 20th century, only to be buried by the banking elite. It is known as the Chicago Plan, and it is the best available path to restoring American solvency without unleashing hyperinflation or financial collapse.

Ending the Debt-Based Monetary System

Under the current system, every dollar in circulation is issued as debt. Private banks create money out of thin air when they issue loans, and the government borrows from them to finance its deficits. This arrangement has led to an economy drowning in interest-bearing debt, where money only exists if someone, somewhere, is in debt for it.

The Chicago Plan changes everything. Instead of money being created by private banks through loans, only the U.S. government would have the power to issue new money—and it would do so debt-free. Banks would be required to hold 100% reserves, meaning they could no longer create money by lending more than they actually possess. This means that every bank deposit in the country—currently around $21 trillion—would have to be fully backed by government-issued currency. In this new system, money would no longer be a loan but an asset, permanently circulating without requiring perpetual debt expansion.

While it has its share of critics, the Chicago Plan has been rigorously analyzed by economists, including the IMF’s own research, and found to be not only viable but economically superior to our current system in many ways. Implementing it would allow us to monetize the majority of the U.S. national debt without causing inflation, while simultaneously eliminating the banking sector’s ability to hold the economy hostage through credit manipulation.

The efficacy of the Chicago Plan demands that we answer the obvious question: If it’s so good, why hasn’t it been implemented? The blunt answer is that the banking sector likes to hold the economy hostage. Bank policymakers will never, of their own accord, implement the Chicago Plan; and under the iron grip of Deep Banking, the Chicago Plan has been relegated to a talking point for libertarian eccentrics like Ron Paul.

But if Federal Reserve policy reform is outside the Overtown Window of mainstream discourse, solving the national debt crisis is not — and it’s in that context we are proposing this plan. Unfortunately, the economists who proposed the Chicago Plan didn’t make the case; when they wrote the plan, the debt wasn’t much of an issue. What follows, therefore, is my own recommendation of how to implement the Chicago Plan in a way that solves our debt crisis without triggering hyperinflation and without repudiating or monetizing our international debt.

Breaking Down the U.S. Debt

To understand how my plan works, let’s examine what the U.S. actually owes. The national debt is composed of three primary parts.

First, there is intragovernmental debt, which consists of Treasury securities held by various government trust funds, such as Social Security and Medicare. This is money the government owes itself, accounting for about $6 trillion of the total debt.

Second, there is domestically held public debt, which includes Treasury bonds owned by U.S. banks, pension funds, corporations, and the Federal Reserve itself. This portion, approximately $16 trillion, is what the government actually owes to its own citizens and financial institutions.

Finally, there is foreign-held debt, currently around $7.5 trillion, held primarily by China, Japan, Saudi Arabia, and other foreign investors. This is the debt that actually matters in terms of international credibility—if the U.S. were to default on this, the dollar’s status as the world reserve currency could be jeopardized.

The astute reader will doubtless have noticed that the amount of money that would be created under the Chicago Plan ($21 trillion) is suspiciously similar to the sum of intragovernmental debt and domestically-held public debt ($22 trillion). And that’s how the Chicago Plan can monetize the debt without creating inflation or triggering dedollarizatoin.

Monetizing the Debt Without Inducing Hyperinflation or Dedollarization

The fear of monetizing the debt—the reason the political and financial establishment recoils at this idea—is hyperinflation. The logic goes like this: if the government simply prints new money to pay off its debts, the supply of dollars in circulation skyrockets, causing prices to surge as each dollar loses value.

But monetizing the debt under the Chicago Plan does not create new money—it replaces old, bank-created money with sovereign, government-issued money. The transition would work as follows:

First, the government would abolish fractional-reserve banking and implement a 100% reserve requirement. To accomplish this, the Treasury would create $21 trillion in new, debt-free money to replace the $21 trillion in private bank liabilities that currently masquerade as dollars.

Since this newly created money would be required to back all bank deposits, it would not create excess liquidity in the economy—it would simply replace one form of money with another. This ensures that inflationary pressures are neutralized.

Next, the government would use this newly issued money to retire the entire $6 trillion in intragovernmental debt. Instead of rolling over Treasury securities held by the Social Security Trust Fund and Medicare Trust Fund, the Treasury would simply exchange them for new sovereign money, erasing this debt completely.

After that, the government would repurchase domestically held Treasuries from U.S. banks and institutions, effectively wiping out another $16 trillion in debt. Since these banks will already be required to hold their deposits in 100% reserves, they would accept sovereign money in exchange for their Treasuries without disrupting financial stability.

By the end of this process, the vast majority of U.S. debt would be eliminated, without causing hyperinflation. The money supply would remain stable, and banks would no longer have the power to create debt-based money.

Meanwhile, all foreign-held U.S. Treasuries would be repaid in full according to their current terms. Defaulting on, or monetizing, these obligations would shatter international confidence in the dollar, potentially triggering a global financial crisis. Instead, by eliminating all other debts, the United States would drastically reduce its debt-to-GDP ratio, strengthening the dollar rather than devaluing it.

Foreign creditors would see their holdings become more valuable, not less. Instead of facing a dollar weakened by endless deficit spending, they would hold assets in a currency backed by a fiscally sound nation—one that no longer needs to issue trillions in new debt just to keep the system afloat.

Thus, if implemented, the Chicago Plan would eliminate our national debt, avoid dedollarization, and immediately and permanently end America’s reliance on debt to sustain its economy. The government would no longer borrow from banks or foreign creditors to fund its operations. Taxes would go directly toward services, rather than being siphoned off to pay interest on old debts. Banks would return to their proper function—allocating capital based on real savings, not conjuring money out of thin air.

It would also end the financialization of the U.S. economy and the dominance of Deep Banking over our country. No longer would the economy be held hostage to the whims of central bankers and Wall Street. No longer would recessions be caused by credit booms and busts engineered by a banking cartel. The financial system would finally be stable and transparent. It might even be further reformed into a truly “hard money” system!

The alternative?

The national debt continues to grow. The debt spiral continues. Interest payments consume the budget. The government prints money to service debt, creating even more debt while triggering real inflation. Foreign creditors begin dumping Treasuries. The dollar collapses. And America—the empire that ruled the world on the back of its limitless credit—follows every other empire before it into the dust.

Contemplate this on the Tree of Woe.

This increase has been so vast that it begs for a deeper explanation. I don’t want to devote this entire article to the entitlement spending problem, so let me summarize it as follows: Among the major drivers of the increase are the shrinking size of the workforce relative to the retired problem; the general increase in healthcare cost; the increasing life expectancy of retirees; and the expansion of benefits, particularly the expansion of Medicare to cover prescription drugs and the expansion of Medicaid eligibility under the ACA. Entitlement spending is now the largest driver of U.S. government debt growth. There is no question that, unless reforms are made, the system will become unsustainable.

However, when developing reforms for dynamic systems, I believe it is better to approach each individual problem as if the other problems can’t be fixed. Therefore, when I approached U.S. tax policy, I assumed that the problems of entitlement spending and national debt could not be fixed, even as I showed that taxes could be adjusted to meet the required budget. Now that I am discussed U.S. money policy, I am doing so assuming that the problems of tax policy and entitlement spending cannot be fixed, even as I am showing that monetary reform can address the national debt problem.

I will eventually integrate it all together — but I have to lay this groundwork first. I therefore beg the reader’s indulgence; anyone who responds “Well acksually we should just cut spending” will be taken out and shot.

Give a man a gun, and he can rob a bank. Give a man a bank, and he can rob the world.

I cannot place my finger on it precisely, but this seems too easy. If you make that much debt disappear, SOMEBODY should be taking a financial haircut of extraordinary magnitude. Who?

On the other hand, maybe the government has already done most of the Chicago Plan, albeit in an obfuscated manner. According to the official inflation rate of 2.9%, Treasury Bills (rate 4.3%) have a real rate of return of 1.4%. Throw in the income tax on that nominal rate and the real ROI drops further. Alas, the Shadow Stats site does not show up to date inflation numbers, but looking at the history, it is possible that the real inflation rate is just as high as the treasury bond rate.

Real interest rates for demand accounts are negative.

Do commercial banks finance mortgages any more? Or are they just retailers with mortgages financed with equity money via FANNIE MAE and FREDDIE MAC?

The Federal Reserve has gotten mighty creative in the last decade. Too creative.

But what they have been doing has been sort of working.

Explicitly doing the Chicago Plan might be [mostly] formalizing what is already going on. (Another study of the Federal Reserve's balance sheet is in order, but I lack the time.)