The System is Down!

De-Dollarization is Here and You Need to Be Ready for What's Next.

On December 28, 2022, in an essay entitled “Predictions and Prophecies for 2023,” I made exactly one prediction for the year ahead:

The Petrodollar System will end! As I explained in my series Running on Empty, the petrodollar is the centerpiece of American hegemony. I predict that in 2023, at the latest 2024, that system will end. Its demise may be disguised by the mainstream and financial press, but it will be self-evident in the transactions themselves, and its aftershocks will be mighty.

Here’s what has happened since:

Jan 17, 2023: Russia and Iran began collaborating to create a gold-backed cryptocurrency.

Jan 19, 2023: The UAE and India began negotiating to use rupees for trading non-oil commodities, shifting away from the US dollar.

Jan 22, 2023: Brazil and Argentina began discussing the establishment of a common currency for the two largest economies in South America.

Feb 10, 2023: Russia announced a voluntary reduction in oil production by 500,000 barrels per day (BDD).

March 8, 2023: Central banks began buying gold at the fastest pace since 1967 to diversify their reserves away from the US dollar.

March 19, 2023: For the first time in 48 years, Saudi Arabia expressed an openness to trading oil in currencies other than the US dollar.

March 24, 2023: Saudi Arabia agreed to sell oil to Kenya for Kenyan shillings instead of US dollars.

March 27, 2023: Saudi Aramco Buys 10% of China’s giant refining company Rongsheng Petrochemical Co.

March 27, 2023: The BRICS bloc overtook the G7 block in Global GDP.

March 29, 2023: Saudi Arabia’s cabinet approved a decision to join the Shanghai Cooperation Organization as a dialogue partner.

March 29, 2023: China and Brazil agreed to ditch the dollar and settle trades in each other's currencies.

March 29, 2023: The world’s richest man called de-dollarization “a serious issue” and warned that countries want to ditch the dollar.

March 30, 2023: China began purchasing natural gas trade from France, settling the transaction in yuan rather than dollars.

March 30, 2023: The BRICS countries announced they had begun work on a new currency to replace the dollar as the global reserve currency.

April 1, 2023: India and Malaysia agreed that trade between the two nations can now be settled using the Indian Rupee instead of the dollar.

April 2, 2023: Oman announced it will voluntarily cut its oil output by 40,000 bpd until the end of 2023.

April 2, 2023: Algeria announced it will voluntarily cut its oil output by 48,000 bpd until the end of 2023.

April 2, 2023: Kuwait announced it will voluntarily cut its oil output by 128,000 bpd until the end of 2023.

April 2, 2023: UAE announced it will voluntarily cut its oil output by 144,000 bpd until the end of 2023.

April 2, 2023: Iraq announced it will voluntarily cut its oil output by 211,000 bpd until the end of 2023.

April 2, 2023: Saudi Arabia announced it will voluntarily cut its oil output by 500,000 bpd until the end of 2023.

April 3, 2023: China’s yuan replaced the dollar for the first time as the most-traded currency in Russia.

April 3, 2023: De-dollarization discussions on Twitter and Reddit surged 600% compared to the prior three months.

In his novel Goldfinger, Ian Fleming famously said “Once is happenstance. Twice is coincidence. Three times is enemy action.” We’re well past three events. This is not a “trend”. This is a globally coordinated action against the petrodollar and there’s no mistaking what it means.

It means the Petrodollar System that has served as the bedrock of world finance since the 1970s is over.

It means I’ve been proven right even faster than I expected.

What is altogether depressing, yet not at all surprising, is how the press coverage of these shocking events has (a) utterly misunderstood their causality and (b) grossly underestimated their gravity. I’m going to use article over at VisualCapitalist.com as my punching bag because it so perfectly captures everything that’s wrong with our mainstream elite.

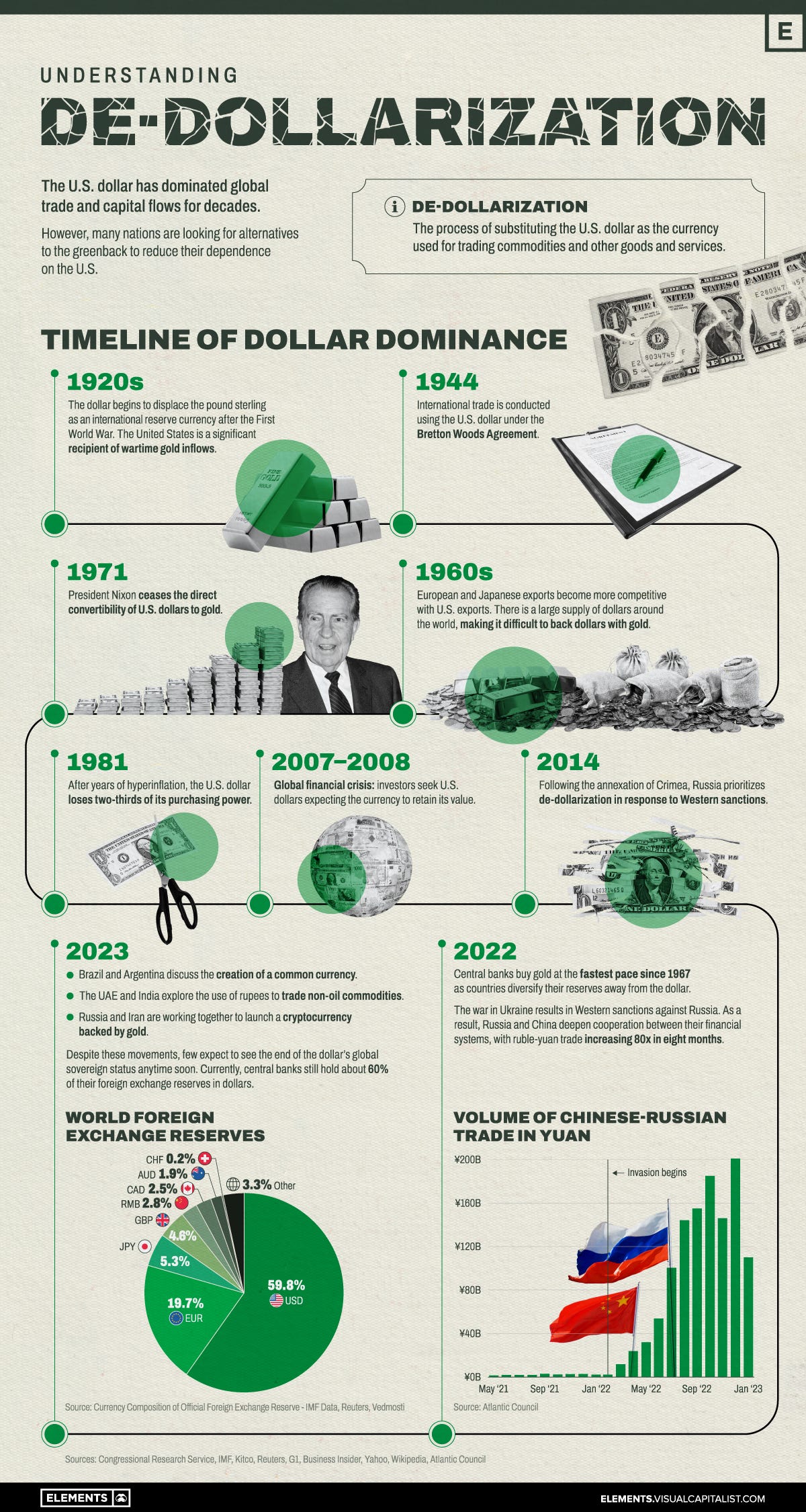

On March 30th, VisualCapitalist.com published this inforgraphic:

Now, this infographic purports to be a guide to “understanding de-dollarization.” Yet do you note what is astonishingly absent from it? No?

How about the explanation of why the US stayed the international reserve currency despite being removed from the gold standard and undergoing 67% inflation over a decade?

How can they purport to explain de-dollarization if they can’t or don’t explain the “re-dollarization” brought about the US-Saudi deal?

Perhaps the famous Far Side cartoon was actually about the mystery of what happened in 1971?

Being either ignorant of or unwilling to acknowledge the petro-military basis of our financial order, VisualCapitalist.com then proceeds to misdiagnose the reason for the dollar’s precipitous decline, writing:

Concerned about America’s dominance over the global financial system and the country’s ability to ‘weaponize’ it, other nations have been testing alternatives to reduce the dollar’s hegemony…

They have entirely confused cause and effect. Other nations have been testing alternatives to reduce the dollar’s hegemony since, well, since the dollar has been hegemonic. All prior “tests” have resulted in the destructing of whichever regime was performing the test. Ask Muammar Gaddafi how his gold dinar worked out.

As I documented in Running on Empty (now available as a book!), since 1971 America’s dominance over the global financial system has been based on America’s military dominance over the Middle East. Now that America’s military dominance has declined, athe country’s dominance over global finance has declined, too. Therefore, the honest way to report the news would be to say:

Unconcerned about America’s purported military dominance and tired of the country’s increasingly punitive attempts to ‘weaponize’ the dollar to make up for it, nations have been testing alternatives to reduce the dollar’s hegemony…

Because that is what is actually happening. Of course no one will say that.1

And what will be the consequences of this global event? Our friends at VisualCapitalist.com assert:

Despite these movements, few expect to see the end of the dollar’s global sovereign status anytime soon.

And they’re right. Very few experts expect to see the end of the dollar’s global sovereign status anytime soon. That’s because the majority of experts are too stupid to realize it’s already ended. The meat is already burned and they’re warning us that things might get medium-rare.

Somewhat more intelligently, the American Institute for Economic Research at least admits that “De-Dollarization Has Begun” and cautions that — gee golly — it might have some “side effects”:

Owing to the role that dollar pervasiveness plays in the international appetite for US Treasuries, a side effect of the long-term attempt to establish alternative reserve currencies may be decreasing interest in tradable US debt. Over shorter time frames, that would likely result in higher yields and higher levels of debt service on securities issued by the US Treasury. Over generational time frames, that shift could force a reduction in US government spending. Should that scenario play out, the long-term effect of using access to dollars as a bludgeon of American foreign policy could well be higher average inflation and/or higher taxes on American citizens. (emphasis added)

“Higher levels of debt service”? “Higher average inflation and/or higher taxes”? Could you possibly be understate the problem anymore? Really? Next up, the American Institute for Economic Research will warn that the eruption of Yellowstone Caldera super-volcano might spoil holiday travel plans. Come on.

This is what America’s financial situation looks like:

Our deficit already exceeds revenue. And our debt is $30 trillion. That doesn’t include our country’s unfunded government liabilities, consumer debt, corporate debt, state debt, or municipal debt. The depth of our debt level is so severe that when Russia drilled the Kola Superdeep Borehole, it discovered Treasury Bonds at 40,452 feet depth, a discovery so fearsome it spanned a whole genre of creepypasta.

Given the magnitude of our debt, we simply cannot afford higher levels of debt service — it will bankrupt us. The only way that debt iceberg has been manageable is because we were able to monetize and recycle the debt, via the Petrodollar System, into asset inflation. With de-dollarization that won’t happen. Our only choices soon will be hyperinflation or debt deflation, and both will be catastrophic.

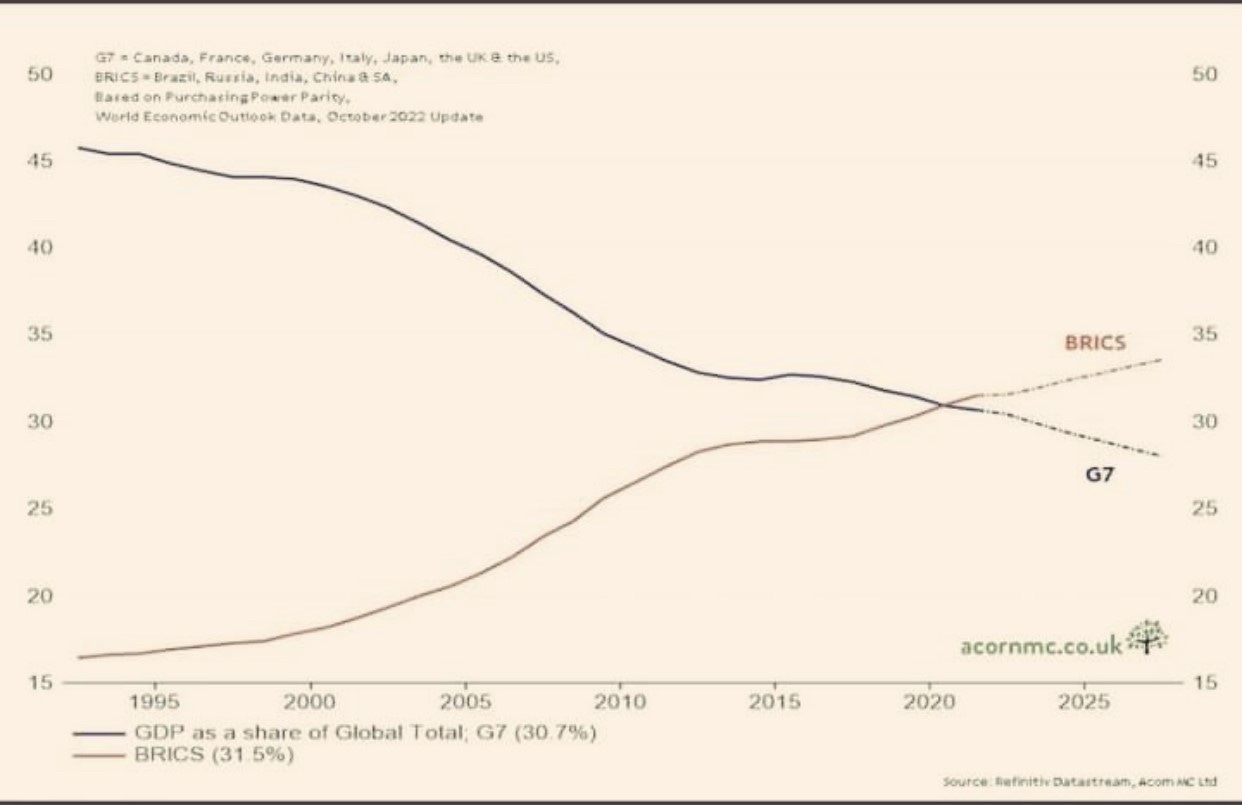

And if you think our expert class has a plan to save the day, don’t kid yourself. They’re clueless. In 2020, the superintelligences at Goldman Sach were warning that the BRICS bloc might overtake the G7 in global GDP by 2027. Meanwhile, in reality, it actually happened at the end of 2022.

Friends, the Petrodollar System is down:

Contemplate this on the Tree of Woe.

Except Gary Brode of Deep Knowledge Investing, who somehow manages to say actually true things while maintaining a career in finance.

Great news for those with negative net worth.

Congratulations for being right far ahead of schedule!

I for one pity those poor fools.

All that MSM “hopespeaking” will not prevent those inevitable thousand degree suntans, followed by the vile cannibalism, sodomy and necrophilia which in turn will be followed by feral “rewilded” dogs ripping their former petowners and what have you into teeny weeny pieces….

So cut them some slack! It’s akin to a man condemned to death via electric chair trying to convince himself (moments before his inevitable death) that he can Volt Absorb everything and become a superhero.

Rule #1 of Hopedevouring/Doomporn: Always let the Hopespeaker start with ALL of their presuppositions and their “less negative” + positive immediate consequences. Makes the inevitable descent that they have into madness all the more amusing!